17 January 2023

Last quarter, we reported a continuation of the market volatility that was prevalent throughout most of 2022.

The Russian invasion of Ukraine, attempts by central banks to handle rising inflation, and the long-lasting economic effects of the Covid-19 pandemic all took their toll on global stock markets, leading to downturns in many sectors across the year.

Happily, investors saw some relief in Q4 2022, with worldwide indices showing positive returns for the first time in months.

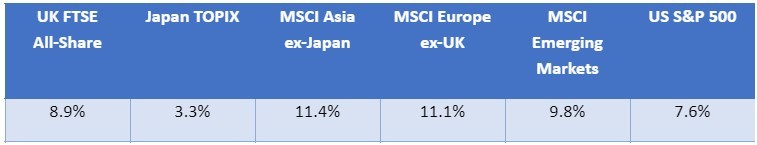

As you can see from the below table, global stocks rebounded in Q4. The table shows the returns over the three months to the end of December 2022.

Source: JP Morgan

After China’s relaxation of its strict Covid-19 policy, banks raising interest rates across the UK and Europe, and gains across commodities, markets finally experienced gains at the end of 2022.

Despite more lucrative performances in Q4, the overall view at the end of 2022 was still one of volatility.

The below table shows the performance of global indices across the whole of the year.

Source: JP Morgan

As an investor, this turning of the tide could remind you to touch base with your financial planner, who can help review your wealth goals. Although past performance is not a reliable indicator of future performance, and the value of your investments can go down as well as up, the future could be brighter for investors this year.

Read on to find out how different regions performed across Q4 2022.

UK

The UK’s political scene proved chaotic in 2022, but in Q4, the situation stabilised. After the controversial September mini-Budget sent markets into disarray, the appointment of chancellor Jeremy Hunt was reassuring to investors.

In his autumn statement, Hunt marked a firm departure from the risk-taking attitude of his predecessor, Kwasi Kwarteng. Cutting tax breaks for unearned income, putting firm plans in place for GDP growth, and acknowledging his awareness of the difficulties the UK economy is facing all stabilised the outlook for the UK’s fiscal future.

Coupled with the presence of the new prime minister, Rishi Sunak, who is well-known for his financial conservatism, the UK government has taken a more measured approach.

Plus, the Bank of England (BoE) showed signs of slowing its continuous raising of the base rate. The base rate increased from 0.1% to 3.5% in the year to December 2022 – but crucially, its most recent rise was just 0.5 percentage points, compared with the previous rise which was by 0.75 percentage points.

So, although the Office for National Statistics (ONS) reports inflation stood at 10.1% as 2022 ended, it seems investors are confident inflation and interest rates will steady this year.

With the UK FTSE All-Share posting 8.9% growth in the quarter and 0.3% growth over the whole of 2022, UK investors could feel assured overall moving into Q1 2023.

It is important to remember that, like much of the west, the UK is said to have entered a recession in Q3 2022, and its economy may continue to contract as 2023 progresses.

US

Much like the UK, indications that the Federal Reserve (Fed) is beginning to slow its increases in interest rates helped investor confidence in Q4.

US year-on-year inflation stood at 7.1% as 2022 drew to a close, according to Trading Economics, and after four consecutive interest rate rises of 0.75 percentage points, the Fed implemented a 0.5 percentage point increase at the end of the year too.

This measured increase signifies a slowing down in their plan to tackle inflation, and may have boosted investments over the quarter. However, Schroders reports the policy of continuously increasing interest rates is set to continue into 2023, meaning investors should be aware of potential further hikes.

What’s more, there were record profits reported in the commodities sector, including energy companies Exxon and Chevron, which made huge gains.

Although the US S&P 500 reported 7.6% growth in Q4 2022, the bigger picture of the whole year shows the value of the index fell by 18.1%. Investors can hope to see continued gains in 2023, yet may choose to remain cautious as some market volatility prevails.

Europe

Throughout 2022, Europe was perhaps hardest hit by the inflationary conditions caused by Russia’s invasion of Ukraine in February.

As the war continues, these conditions have been prolonged – however, in a turning point for the Eurozone, the MSCI Europe (excluding the UK) index showed gains of 11.1% in Q4. When compared with the 4.5% negative growth reported in Q3, this is positive news for European markets.

In recession news, Schroders reports that the Eurozone economy grew by 0.3% quarter-on-quarter in Q3, compared to 0.8% growth in Q2. Some forecasters predict further contraction of growth is likely in 2023.

Equity gains were boosted following investors’ hopes that European inflation has peaked at the end of 2022. According to Eurostat, inflation reached 10.1% in November 2022, down from 10.6% in October.

One of the most impactful economic conditions for Europe in 2022 was energy prices. In Q4 2022, unseasonably mild weather drove gas prices down as demand fell compared to what was expected.

Asia

The biggest headline for Asian markets in Q4 2022 was China’s relaxation of its zero-tolerance Covid-19 policy. With lockdowns easing in the country, markets almost instantly rebounded.

This rebounding is evident in the figures: the MSCI Asia (excluding Japan) index reports 11.4% growth in Q4, compared with negative growth of 19.4% in Q3.

The surge in gains across Asia was further helped by US President Joe Biden and Chinese President Xi Jinping’s commitments to a more amicable relationship between the countries at the 2022 G20 summit.

Outside of China, Taiwanese markets unfortunately remained volatile. Decreased demand for electronic goods, one of Taiwan’s main exports, combined with political tensions ensured a volatile quarter for the country.

More positively, Singapore, the Philippines, and Thailand all posted positive stock market growth in the fourth quarter of 2022.

In Japan, the quarter was also positive, with the TOPIX index rising by 3.3% across the quarter.

Get in touch

If you wish to review your investment portfolio, or have any questions about global or UK markets, get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Your Q4 2022 market update

There are 0 comments on Your Q4 2022 market update