14th January 2021

It’s fair to say that 2020 was a tumultuous year for investors. The coronavirus pandemic affected almost all aspects of the economy, and global share prices were hit as businesses were forced to scale back operations and, in many instances, close.

Despite this, the news of effective vaccines meant that Q4 saw more positive economic news. Global stock markets saw double-digit growth in the final three months of the year, with emerging markets leading the way as shown in the table below.

| MSCI Emerging Markets | MSCI Asia ex-Japan | UK FTSE All-Share | US S&P 500 | Japan TOPIX | MSCI Europe ex-UK |

| 19.8% | 18.7% | 12.6% | 12.2% | 11.2% | 10.2% |

Source: JP Morgan

With light at the end of the tunnel, here’s our look back at the last three months of 2020.

UK

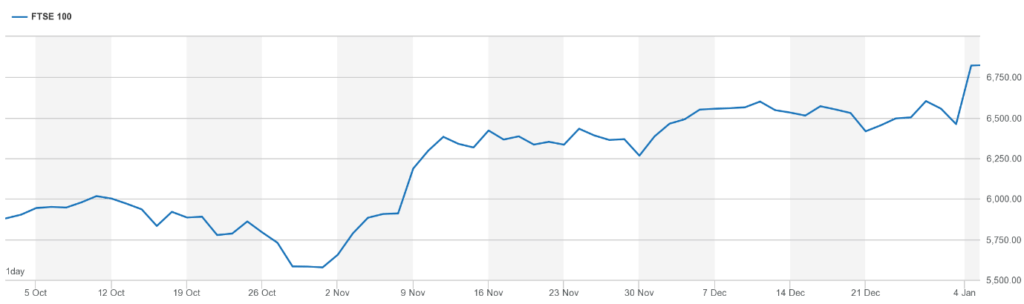

The final quarter of 2020 was positive for the UK stock market. Breakthroughs in a Covid-19 vaccine and the slow movement towards a Brexit trade agreement saw the FTSE 100 rise by around 10% over the final three months of the year, closing at 6,460 on New Year’s Eve. The index has risen further in the first few days of 2021.

Source: London Stock Exchange

In the UK, both house prices and November retail spending were up year-on-year, despite further tier and lockdown restrictions. Nevertheless, GDP remains substantially lower than its level in February leaving plenty of room for recovery once the vaccines have been rolled out.

Looking back at 2020, Britain’s blue-chip share index suffered its worst year since the 2008 financial crisis. It has been a volatile year for investors, with the 14.3% fall in the value of the FTSE 100 during 2020 representing the poorest performance among the largest international stock indices.

The FTSE 250 index of medium-sized companies, more focused on the UK economy, fell by 6.4% during 2020.

The FTSE 100 was dragged down by the impact of coronavirus on several key sectors. The parent company of British Airways, IAG, slumped by 61% during the year, with jet engine manufacturer Rolls-Royce down 52%. Oil companies also had a difficult year, with BP and Royal Dutch Shell dropping by over 40% during 2020.

Banks were also badly hit by the pandemic, with Lloyds Banking Group falling 41% in 2020 and NatWest down 30%.

Europe

As in the UK, the value of European equities rose sharply in Q4 on the news of effective Covid-19 vaccines. Sectors that had previously suffered most severely from the pandemic, such as energy and financials, were the top gainers.

After overcoming opposition from Poland and Hungary, EU leaders approved a €1.8 trillion budget package, including a €750 billion recovery fund.

Of course, European economies were also boosted by the news that the EU had agreed a Brexit trade deal with the UK.

The performance of European stock markets varied in 2020, with Germany’s DAX index ending up 3.6% while France’s CAC fell by around 7%. Spain’s IBEX 35 had an even worse year than the FTSE 100 as it slumped by 15.5%.

US

While the FTSE 100 struggled, the US stock market hit a series of record highs over the final few weeks of 2020. The S&P 500 closed 16.26% up for the year at a new peak, while the Nasdaq surged by 43%.

November 2020 was a particularly strong month on news of effective Covid-19 vaccines, while a $900 billion stimulus package announced in late December represented a welcome boost.

It is still early days to see what effect the election of Joe Biden will have on the US economy, but it’s encouraging that markets have been relatively calm during what has become a difficult transition period.

With the Democrats winning both run-off elections in Georgia and taking control of the Senate it will be easier for the incoming President to enact his agenda, and this is likely to include significant support for the US economy as a vaccination roll-out programme begins.

Asia

After a bumpy start 2020 was a positive year for many Asian economies. Japan’s Nikkei gained 16% in 2020, driven by a strong rally in the final three months of the year on vaccine news and the outcome of the US election.

Meanwhile, China’s CSI 300 surged 27% during 2020. Strong demand for medical supplies and tech products lifted Chinese exports to the highest monthly nominal level on record in November.

South Korea markets saw strong growth aided by gains from the tech sector while Indonesia, Taiwan, the Philippines, and India also finished ahead of the Asia (ex-Japan) index.

Get in touch

If you have any questions about what the ongoing uncertainty means for you, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Comments on Your Q4 2020 investment update

There are 0 comments on Your Q4 2020 investment update