19th October 2021

After a positive few months, the third quarter saw global markets become more uncertain. Fears of rising inflation, increasing fuel prices, and continued Covid issues means the MSCI World Index was essentially flat during the three months to the end of September 2021.

Emerging and Asian markets were particularly hard hit, most notably in China which struggled with energy shortages and concerns over the debt of one of its biggest corporations.

Here’s your look back at a nervy three months in the global economy.

UK

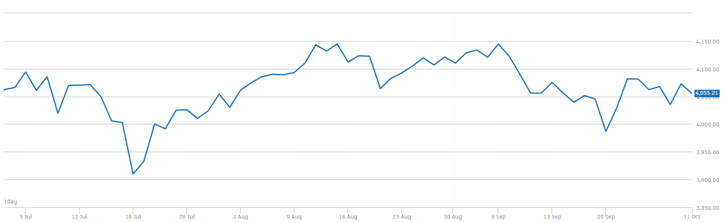

As you can see from the chart below, UK equities (represented by the FTSE All-Share Index) ended the quarter at roughly the same value as they started it.

Source: FTSE

Concerns about the potential for rising unemployment at the end of furlough, Brexit-related fuel and food shortages, and rising global energy prices saw the FTSE fall in September.

The Bank of England took a more hawkish tone in Q3 as inflationary pressures continued to surpass expectations. Inflation rose to 3.2% in August – significantly ahead of the Bank’s 2% target – with some expecting the rate to hit 4% before the end of 2021.

Business surveys confirmed that supply bottlenecks are constraining output, while rising gas costs saw many factories pausing or restricting output.

A potential shortage of Irn-Bru was just one of the potential consequences of a cocktail of issues that hit British manufacturing over the three months to September.

USA

While US equities showed a small positive return in Q3, earlier gains were largely wiped out in September by concerns about both growth and rising inflation.

The Fed stated in September that they will announce a tapering of quantitative easing at the November meeting and will finish by mid-2022.

The Fed funds rate projection also shows a faster rate increase schedule than they did at the end of Q2. Fed officials were evenly split on an interest rate increase in 2022, but the expectations are now for three increases in 2023 and a further three rises in 2024.

The shift comes in the context of revised real GDP growth, which is down to 5.9% for 2021 from the 7% growth previously estimated. Inflation has also risen, with the Fed now seeing inflation running to 4.2% this year, above its previous estimate of 3.4%.

The Fed raised its GDP projections for 2022 and 2023 to growth of 3.8% and 2.5%, respectively.

Europe

Despite good gains at the start of the quarter, Eurozone equities were overall flat in Q3.

While most Eurozone countries have vaccinated around 75% of their population against the virus, enabling restrictions and travel bans to be lifted, ongoing concerns about energy prices, supply chain disruption and inflation saw indices fall back.

Countries including Spain have announced energy price caps, which hit the utilities sector.

The energy sector was one of the strongest performers, while consumer discretionary stocks were among the weakest for the quarter. This was partly due to suggestions that China may seek greater wealth distribution, which could hurt demand for luxury goods.

Annual inflation in the Eurozone was estimated at 3.4% in September, up from 3.0% in August and 2.2% in July.

As Angela Merkel’s tenure as Chancellor of Germany came to an end, the Social Democrats (SPD) took the largest share of the vote. Coalition talks are continuing before a new government is formed.

Asia

Asian equities fell sharply in Q3, largely driven by a significant sell-off in China.

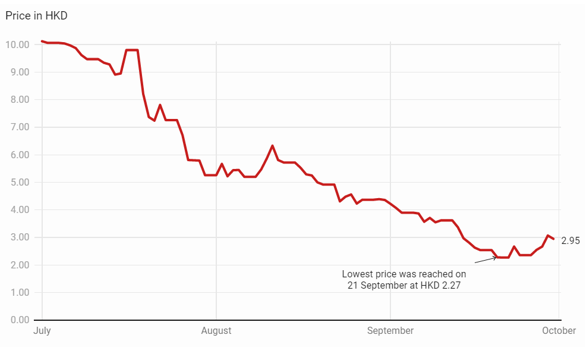

One of the leading reasons was a concern over the ability of the property group Evergrande to service its debts. The company’s liabilities total about USD305 billion – round about 2% of China’s GDP. The company’s share price fell sharply over the quarter.

Source: Morningstar

Evergrande’s problems, and wider concerns about the country’s property market, caused ratings agency Fitch to downgrade its forecast for the Chinese economy in September.

Sentiment towards China was also weakened by a series of power outages and the rationing of energy. In September, 16 of 31 provinces in industrial regions implemented electricity rationing with the shortage of power leading to the failure of traffic lights in some cities.

The Japanese equity market rose in September to record a total return of 5.2% for the quarter. While Japan has consistently seen a lower Covid-19 infection rate than most developed countries, it faced a much more serious test during early summer as infections increased rapidly.

Public opposition towards the government’s approach increased and, in early September, prime minister Suga announced his intention to resign. Fumio Kishida was ultimately elected as LDP party leader and became Japan’s 100th prime minister.

Get in touch

If you have any questions about the ongoing uncertainty in global markets, and how this may affect you, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Comments on Your Q3 2021 market update

There are 0 comments on Your Q3 2021 market update