In our last market update, we were reporting on significant falls across global stock markets as a consequence of the coronavirus pandemic. Many experts were pessimistic about the chances of a swift economic recovery with many developed countries set to enter a deep recession as unemployment rates spiralled across the globe.

There do now appear to be more reasons to be cheerful. Most stock markets recorded significant rises between April and the end of June – indeed, the S&P 500 had its best quarter since 1998, and the FTSE 100 its best since 2010.

Here’s our look back at the last three months.

UK

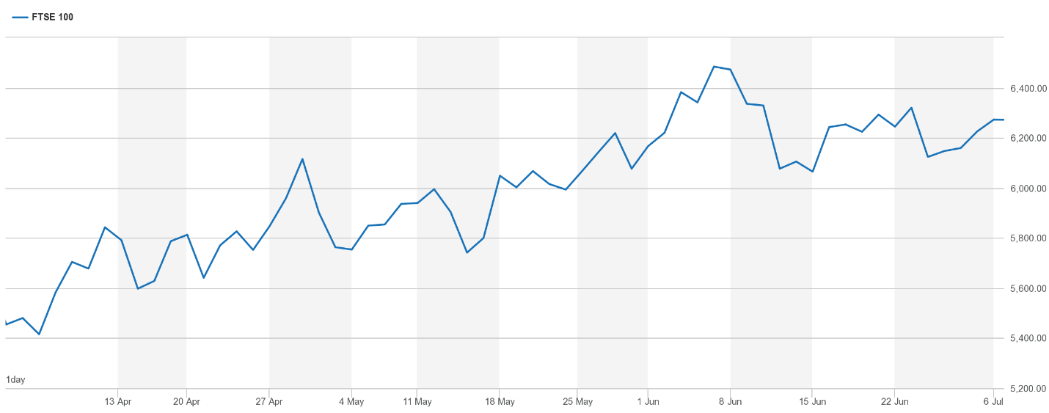

After sharp falls as the coronavirus pandemic took hold, the FTSE 100 index actually rose by 15% in the second quarter of 2020. At the end of June, the index sat around 18% down compared to its highest point, in early January 2020.

Source: London Stock Exchange

Over the last few months, markets have seen unprecedented volatility. Overall, the UK stock market has bounced back after big falls, reinforcing our message that investing for the long term requires patience and the ability to hold steady during periods of uncertainty.

While the UK is set for recession, many experts believe it will recover in 2021 and beyond. Investor confidence grew steadily in the second quarter as the trend in infections reversed, and governments and central banks maintained supportive economic policies.

Coutts Head of Asset Allocation Lilian Chovin says: “Unlike the financial crisis in 2009, this isn’t a systemic crisis. The pre-coronavirus economy was in good shape, and the recovery is building on a sound financial foundation.”

The Bank of England continue to provide stimulus to the economy and has extended its bond-buying programme. Interest rates remain at a record low of 0.1% and the central bank have indicated this is where they will remain for some time.

Indeed, the Governor, Andrew Bailey, has suggested that all options are under consideration, including a further cut and even, possibly, negative interest rates.

US

US equities bounced back strongly in Q2 and outperformed other major equity markets. The easing of lockdown restrictions, ongoing loose monetary policy from the Federal Reserve and early indications of a recovery led to widespread equity market gains.

Jerome Powell, chairman of the US central bank, says that the Fed is “…not even thinking about raising rates” while weekly claims for unemployment insurance slowed substantially and retail sales rebounded strongly from April to May.

There is some uncertainty about the rise in cases seen across some US states in June and early July and the possibility of some return to lockdown measures. This could have an impact on general market sentiment depending on the steps taken to combat the rise in cases.

Eurozone

Stock markets across the Eurozone also rebounded in Q2 as countries began to lift lockdown restrictions.

There was also strong central bank support for EU countries. European Commission president Ursula von der Leyen called for the power to borrow €750 billion for a recovery fund to support the worst affected EU regions in addition to a €540 billion rescue package agreed in April. The European Central Bank also offered support, expanding its pandemic emergency purchase programme to €1.35 trillion.

While the Eurozone economy contracted by 3.6% in Q1 (compared to the last three months of 2019), economic activity surveys showed improvement as restrictions were eased. IT saw some of the strongest gains, along with industrials and financials.

Asia

Many Asian countries have managed the coronavirus pandemic successfully, and this should help those economies face less dramatic downturns and faster recoveries.

The Japanese equity market recovered from a weak April to record a total return of 11.3% over the quarter, while export-led economies such as Thailand and Indonesia also recovered quickly as global demand began to increase.

The announcement of a major stimulus package boosted the Indian economy, although there remain concerns about a spike in coronavirus cases in the country. And, while China’s economy continues to bounce back, exports fell by 3.3% year-on-year in May after expanding in April.

Get in touch

If you have any questions about current market conditions, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments on Your Q2 market update

There are 2 comments on Your Q2 market update

Comment by Alan Woods

Hi Andy … over the past few months I have been bombarded with emails text messages and phone calls from people trying to get me involved in the bitcoin market … for as low as a £250 investment they paint a very good picture To the amount of profit one can make … you know I like a gamble on anything so I was thinking of dipping my toe in as its only just what I would spend at the races … what do you think ? Any advise pal ?? Cheers Alan

Comment by Andrew Dobson

An interesting read.

Thank you for a concise update.