20/04/2023

After an uptick in market performance at the end of 2022, Q1 2023 has brought happy news of continued stabilisation. Overall, global equities saw positive returns in Q1 as concerns around a potential recession dampened.

This being said, two US bank collapses spooked consumers and economists alike, and inflation has continued to rise in many parts of the world.

In the wider markets, though, things remained relatively stable throughout Q1.

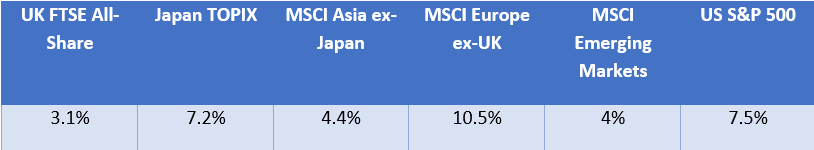

The below table indicates the performance of key global indices in the first quarter of 2023.

Source: JP Morgan

With wholesale oil and gas prices continuing to decline, and recessionary fears kept at bay, this continued buoyancy in the markets could come as welcome news to investors after much of 2022 proved volatile to say the least.

Read on to find out how the US, UK, Asian, and European markets performed over Q1 2023, and some factors contributing to this positive news in the markets.

UK

Q1 2023 was rather unstable for the UK FTSE All-Share. Despite these fluctuations, though, the index posted 3.1% growth in the first quarter of the year.

Zooming in on the FTSE 100, after hitting a new record high in February 2023, the index saw another significant downturn in March. In fact, on 15 March, the index saw its worst day of trading since March 2020.

Fortunately, both the All-Share and the 100 saw subsequent upticks after these downturns in mid-March.

Perhaps linked to the performance of these indices is the spring Budget speech, delivered by chancellor Jeremy Hunt on 15 March 2023. In the Budget, the chancellor unveiled his “plan for growth”, with plans focusing on incentivising older people to return to work, tackling the energy crisis, and encouraging investment.

Headline announcements from the spring Budget include:

- The removal of the pensions Lifetime Allowance (LTA) tax charge from 2023/24, with plans to “fully abolish the LTA in a future Finance Bill”

- Increases to several pension allowances, including the Annual Allowance and Money Purchase Annual Allowance (MPAA), designed to give further tax-efficient retirement savings opportunities

- A policy of “full capital expensing”, set to last until 2026, which will allow firms to claim all investments against their tax bills

- An extension of the Energy Price Guarantee (EPG) until 30 June 2023.

These announcements could be hugely positive for you if you’re hoping to boost your pension contributions or withdraw from a large pot in the coming years.

Unfortunately, despite the positives listed here, inflationary conditions in the UK have prevailed. The Office for National Statistics (ONS) reports CPI inflation reached 10.1% in the year to March 2023, only a slight dip from 10.4% in February.

What’s more, in a continued effort to battle inflation, the Bank of England (BoE) raised the base rate twice in Q1, resulting in a 4.25% rate at the end of March.

US

Understandably, in the last month of Q1 2023, US economic headlines were dominated by the collapse of SVB in March.

After the bank struggled to match rising interest rates after buying up “safe” government-backed mortgage bonds and US Treasury bonds for the past three years, regulators waded in to close SVB on 10 March 2023.

Subsequently, concerns about another banking crisis led to volatility in US markets in March, with some economists lowering their forecasts for economic growth this year as a result.

You can read our full insights into the collapse of Silicon Valley Bank (SVB) on our news page.

Despite these seminal banking events that affected market performance at the end of the quarter, the US S&P 500 reported a 7.5% uptick overall – comforting investors who may have been spooked by SVB’s liquidation.

In a continuation of good news for the US, inflation fell to 6% in February 2023, down from an annual rate of 6.4% in January. While still exceeding its target, the US inflation rate has slowed since the 9.1% peak seen in June 2022.

In spite of bank collapses and volatility concerns, the Fed is still focused on tackling inflation. So, it raised interest rates by 0.25 percentage points in March – although some economists say this was a meagre rise compared to what was planned before the SVB incident. This increase pushed the upper limit of US interest rates to 5% – its highest level since 2007.

Europe

In spite of increasing interest rates, and the collapse of Credit Suisse in March, economic activity was surprisingly high in the eurozone between January and March 2023. Energy prices have continued to fall in the area, perhaps contributing to the increase in consumer spending across the quarter.

Due to the initial increase in inflation at the start of the quarter, the European Central Bank (ECB) increased interest rates by 0.5 percentage points in March, pushing the bank’s main rate up to 3.5%. The strategy clearly has merit, as inflation in the eurozone is predicted to have fallen from 8.5% to 6.9% between February and March, Eurostat reports.

Of course, headlines from the area were focused on two key circumstances: pension protests in France, and the Credit Suisse buyout that followed the collapse of US banks SVB and Signature in March.

Despite these somewhat tumultuous events, the MSCI Europe (excluding UK) index posted 10.5% growth – a promising figure after the difficulty the eurozone experienced in 2022 after the Russian invasion of Ukraine.

Asia

With China’s strict Covid-19 lockdowns fully easing at the beginning of 2023, increased economic activity has been noted throughout the country. A notable increase in travel within China was reported in February 2023, with the most significant impact expected to be felt in the hospitality and tourism sectors.

Importantly, when compared with western territories, inflation in China is slowing at an enviable rate. According to Trading Economics, Chinese inflation decreased to 1% in February, down from 2.1% in January 2023.

Outside China, recessionary concerns in western areas – most notably the UK, the US, and Europe – could present opportunities for Asian markets to rebound. China’s recovery in Q1 2023, coupled with the equity values seen in Asian markets compared with the FTSE UK All-Share, US S&P 500, and MSCI Europe, could put eastern investments in a more stable position in 2023.

Indeed, the MCSI Asia (excluding Japan) ended February up 4.4% from January which, compared with its -19.4% loss at the end of 2022, is an astonishing improvement by any measure. To top it off, the Japan TOPIX saw returns of 7.2% by the end of Q1, too, placing Asian markets in a strong position overall.

As global indices continue to see positive returns, discussing opportunities with your financial planner could be a wise move

With all the indices mentioned here ending Q1 2023 in positive equity, you could be feeling a sense of relief wash over you. After the intense fluctuations of 2022, seeing some stability in your portfolio might bring you peace of mind.

While we have no idea how markets will perform in Q2 and beyond, now could be the time to cast your eye over your investment portfolio with the help of a financial planner.

We can help you look at:

- Your goals for the next year, decade, and few decades

- Whether your portfolio is diversified to meet your appetite for risk

- How recent market upticks have affected your portfolio

- Why it’s important to remain invested for the future.

Your long-term investment strategy is more important than short-term changes in the market – but there’s never a “bad” time to book a review of your portfolio with your financial planner.

Get in touch

To book a portfolio review, or for a conversation about anything you’ve read here, get in touch today. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts and their value depends on the individual circumstances of the investor.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Your Q1 2023 market update

There are 0 comments on Your Q1 2023 market update