The coronavirus has not only inflicted huge emotional hardship across the world, but also vast economic damage.

After a record-breaking 11-years of growth, the longest US bull run in history came to an end in the middle of March. Oil prices fell into negative territory, unemployment has soared, and many thousands of businesses are teetering on the brink of collapse.

There has also been turmoil in global markets, with many experiencing volatile falls and rises – sometimes within a few days of one another.

Here’s your summary of what has been an unprecedented few months in the world economy.

UK

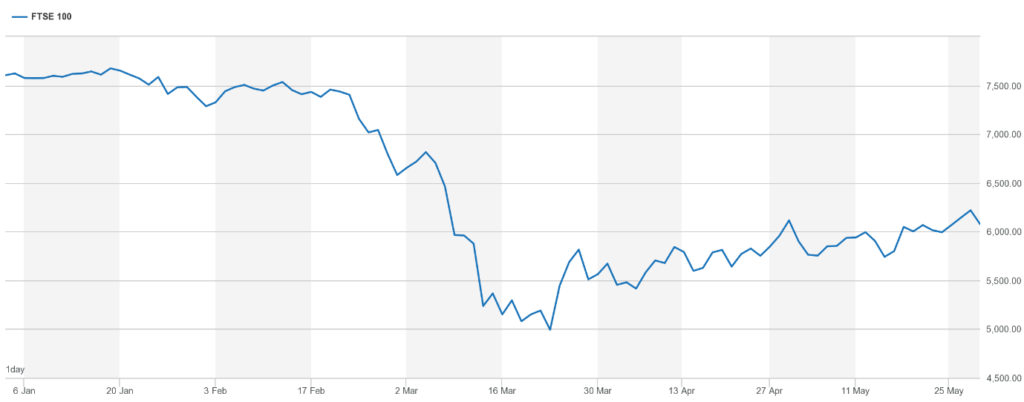

Overall, the FTSE 100 index fell by just under 20% between 1st January and 31st May 2020. At its worst, the index was down by around a third against its peak, although prices have recovered slightly since 12th March when the FTSE suffered its biggest one-day fall since 1987.

Source: London Stock Exchange

While experts are divided about quite how seriously the coronavirus pandemic has affected the UK economy, all are agreed that we are heading for a deep recession.

April saw the biggest increase in the number of people claiming unemployment benefits since records began in the early 1970s, as the overall number of people claiming benefits due to unemployment rose above two million for the first time since 1996.

Considering that ‘furloughed’ staff are not included in unemployment figures, this number could rise sharply when the government begins to withdraw its support for business.

Writing in The Guardian, expert Larry Elliott says: “Without the wage subsidies covering eight million jobs, the UK would be on course for an unemployment rate of about 20%.”

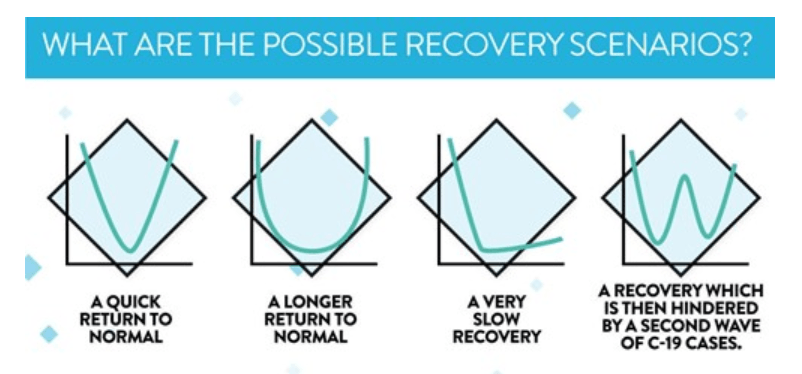

Experts anticipate four possible scenarios for how the UK economy will bounce back after the pandemic eases.

- The V – This is essentially a quick return to normal. This is supported by the fact that there was a strong economy and stock market prior to the pandemic.

- The U – This is a longer return to normal, with lockdown removal taking place gradually with some countries taking longer to recover than others.

- The L – A much slower recovery, which could happen if health concerns continue or if the lockdown and pause of businesses is extended for prolonged periods.

- The W – In this scenario, there would be a recovery similar to the V, but then be hindered by a second wave of Covid-19 cases.

Professor John Turner, a financial expert from Queen’s Management School, fears the government’s package of financial support for employees and businesses is simply a temporary fix and that the long-term consequences are likely to be very painful.

He says: “A lot of people are talking about a V-shaped recovery. Imagine we’ve been playing a piece of music and we’ve pressed pause for a few weeks and the dancing stops. And suddenly when we press play again, the dancing starts where it left off and everything will be back to normal in the economy.

“That’s a very optimistic view in my eyes because people are not all of a sudden going to go out and spend money again. They are going to be more cautious – some will have lost their jobs, and others, anticipating higher taxes and rising inflation as a result of government bailouts, will cut back on their consumption. If people aren’t going to spend money, that is going to dampen the economy for a long, long time to come,” he adds.

US

The economic situation in the US is every bit as bad as it is in other parts of the world. More than 40 million Americans filed for unemployment between mid-March and the end of May – figures the country has not seen since the Great Depression.

The Congressional Budget Office (CBO) expects GDP to be 5.6% smaller in the fourth quarter of 2020 than a year earlier, while Swiss Re foresees a contraction of 6.4% in 2020 before a partial 4.2% rebound in 2021.

Longer term, CBO director Phillip Swagel expects the pandemic to wipe close to $8 trillion off economic growth in the next decade. He says: “Business closures and social distancing measures are expected to curtail consumer spending, while the recent drop in energy prices is projected to severely reduce US investment in the energy sector.”

With the coronavirus pandemic reducing global demand for oil by a third – more than 30 million barrels per day – mid-April also saw a historic moment as oil recorded a negative price. This reduction in demand was compounded by a continuing price war between Russia and Saudi Arabia, with the Saudis flooding the market with oil, dragging prices to an all-time low.

Since the pandemic hit the US, there has also been no de-escalation of the trade dispute between the US and China. With Donald Trump blaming China for the spread of the virus, it looks unlikely that the dispute between the two countries is going to be resolved anytime soon.

Europe

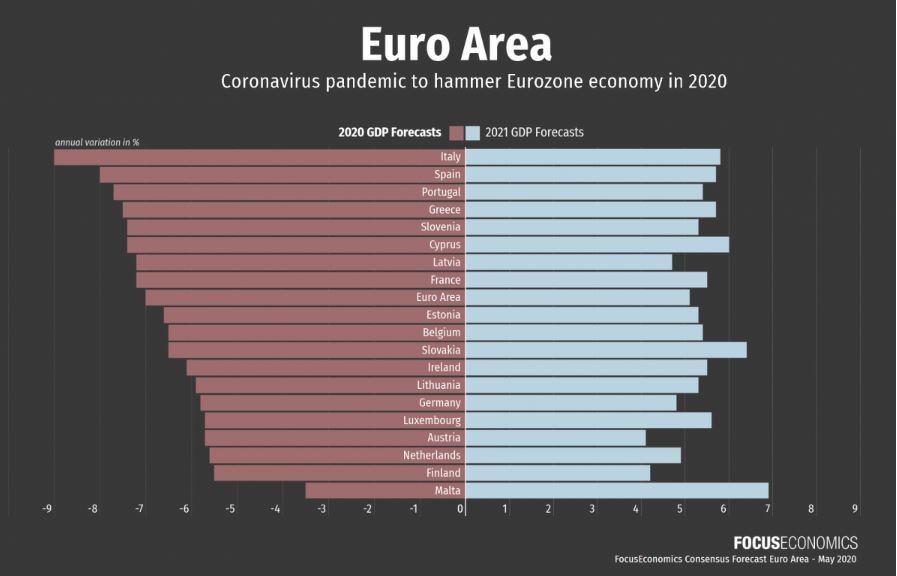

Data from national statistics institutes suggests that Covid-19 wreaked havoc on both domestic and external demand in France, Italy and Spain, while contractions in smaller Eurozone economies were sizeable but less severe.

Figures show that European economies suffered their worst ever contraction in the first quarter, with prospects for the second quarter even bleaker due to protracted lockdown measures.

Source: Focus Economics

Euro area ministers have rolled out an emergency package worth EUR 540 billion, although there is no consensus on how to stimulate the Eurozone economy once the pandemic is over.

Get in touch

Have any queries about our market commentary? Please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Comments on Your 2020 market commentary

There are 0 comments on Your 2020 market commentary