In uncertain periods, it’s very easy for emotions to take over decisions. This is certainly true if we consider the recent stock market uncertainty caused as a result of the coronavirus pandemic. Sharp falls in the market are worrying for any investor, and fear can be a powerful emotion.

However, when your investing decisions are driven by how you feel, rather than by facts, you’re more likely to make mistakes.

One psychological trait that comes into play during periods of market uncertainty is ‘loss aversion’. The fact that humans fear losses more than we value gains can lead us to make poor decisions, and to take less investment risk than we could perhaps tolerate.

Fear of losses can:

- Prevent potential investors from choosing equity-based investments

- Lead to experienced investors taking on too little risk

- Damage your returns as the safety of cash accounts mean you could lose money in real terms due to the effects of inflation

Over your lifetime, irrational ‘loss aversion’ could cost you a significant sum.

What is loss aversion?

The theory of loss aversion suggests that the pain of losing is psychologically more powerful than the pleasure of gaining.

Demonstrated by Amos Tversky and Daniel Kahneman in 1992, the key idea behind loss aversion is that individuals react differently to positive and negative changes. More specifically, the theory suggests that losses are twice as powerful as equivalent gains.

Here’s an example.

You are offered a guaranteed payment of £900 or a 90% chance of winning £1,000 (and a 10% chance of winning nothing).

What would you take?

Most people avoid the risk and take the £900, even though the expected outcome is the same in both cases.

But what if you were asked to choose between losing £900 and taking a 90% chance of losing £1,000 (with a 10% chance of losing nothing)?

Here, most people would prefer the second option, with a 90% chance of losing £1,000. They take a riskier decision in the hope of avoiding a loss.

The consequences of loss aversion for financial decision-making

Considering that individuals feel losses more acutely than they feel gains, it’s perhaps no surprise that loss aversion can have an impact on your financial decision-making.

When making investment decisions, individuals often focus more on the risks associated with an investment rather than on the potential gains. This can be magnified when focusing on an investment that has lost money and ignoring others.

We tend to make decisions to avoid the pain of loss. During two previous periods of market volatility – the dot.com bubble and the global financial crisis – many investors panicked and withdrew their money from equities, contributing to large increases in cash.

1. Source: Federal Reserve Bank of St Louis

To avoid further losses after a fall in the markets, worried investors may be tempted to move their investments to a place they perceive as a ‘safe haven’— such as cash or cash equivalents. However, this safety can come at a cost, namely ‘inflation’.

Once inflation is factored in, remaining in investments which you might consider secure while you wait out stock market volatility could actually lead to an erosion of purchasing power in real terms.

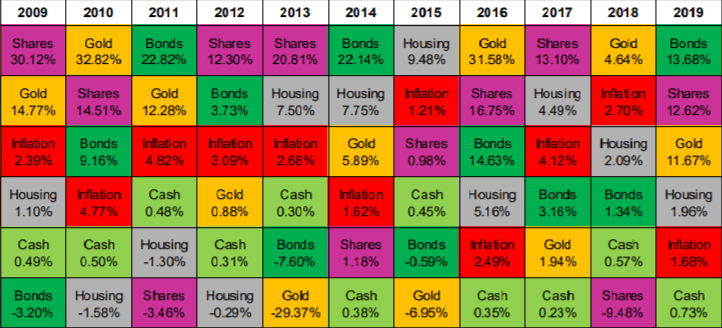

Source: BullionVault

Consider this chart which compares the Retail Price Index (RPI) with cash savings returns over the last decade.

In each of the eleven years, inflation has outstripped cash savings, suggesting that savers who are keeping their money in cash or cash equivalent savings are struggling to maintain their purchasing power in real terms.

Conversely, in seven of the eleven years, returns from shares have outstripped the RPI.

4 loss aversion traps that you can fall into

- Convincing yourself that an investment hasn’t made a loss until you realise that loss

- Investing in cash or low-return investments over more promising investments that come with higher risk

- Not selling an investment (such as shares) you hold when a rational analysis of the share indicates that you should abandon it as an investment

- Realising a slight gain by selling shares when analysis indicated that you should hold the investment for a longer period to generate a larger profit.

The value of advice

A good financial planner isn’t just there to devise a plan, help you to invest your savings and review your holdings once a year. They are also there to act as a sounding board to help you avoid making knee-jerk decisions which could damage your long-term plan.

Naturally, you may have concerns about recent stock market volatility. But, before you act, chat to your adviser first. That’s what we are here for! Email info@depledgeswm.com or call (0161) 8080200.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments on Why loss aversion could be clouding your investment judgement right now

There is 1 comment on Why loss aversion could be clouding your investment judgement right now

Comment by Norman Beenstock

This article has helped me to see my portfolio in a perspective that I had not previously been aware of.