19th October 2021

On 7 September 2021, the prime minister, Boris Johnson, announced the government’s plans to pay for proposed social care reforms and increased NHS funding in England.

The most notable announcements included a new Health and Social Care Levy on employment income alongside an increase in the rates of Dividend Tax.

These two measures are jointly designed to both sort the healthcare backlog created by the pandemic and fund social care in the long term.

So, how will these tax changes impact you? Read on to find out everything you need to know about the new Health and Social Care Levy, including how it will impact you as an employee, an employer, or a self-employed worker.

A 1.25% percentage point increase to National Insurance (NI)

Initially, the new tax will be a 1.25 percentage point increase to National Insurance contributions (NICs) starting from April 2022.

This will affect employees, employers, and self-employed workers.

This will have a marked impact on “Class 1 NI” payments, where amount an employee owes is calculated based on how much they earn.

The Health and Social Care Levy

NICs will then return to their previous level in April 2023, where the rise will become an entirely separate tax called the “Health and Social Care Levy”. This will appear separately to both Income Tax and NICs on payslips.

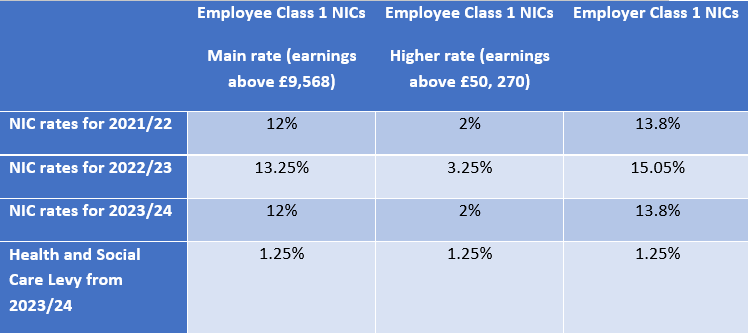

All working adults will have to pay the new tax. Interestingly, State Pensioners who are still in work will have to pay this new levy, despite not having had to pay NI under previous rules. That means Class 1 NICs will look like this until 2023, when the Health and Social Care Levy comes in:

Source: Money Saving Expert

Overall, the tax rise is predicted to raise an additional £12 billion a year.

Increases to Dividend Tax

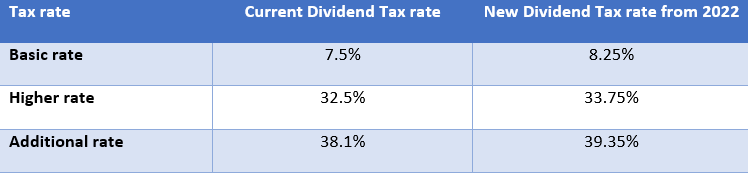

Alongside the Health and Social Care levy, the government is also increasing the rates of Dividend Tax from April 2022 by 1.25 percentage points.

These rates will still depend on your marginal rate of Income Tax, as shown in the table below:

In total, this rise is expected to provide the government with an additional £600 million in revenue.

What this means for workers

In short, the Health and Social Care Levy will see PAYE workers pay more tax on their annual earnings.

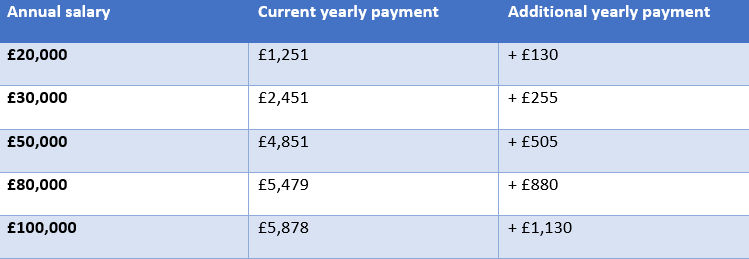

The table below shows how much more this will cost workers, depending on annual salary:

Source: BBC News

Those earning less than £9,564 a year (£797 a month) don’t pay NI under current rules and will also be exempt from paying the new levy when it comes into effect in 2023.

What this means for business owners

As the increase will also be applied to employers, that means business owners will also have to pay extra NICs for staff from April 2022.

According to the Federation of Small Businesses, the hike could put up to 50,000 jobs in small or medium-sized enterprises (SMEs) at risk, costing businesses an estimated £5.7 billion.

Crucially, the Dividend Tax could also have a serious impact on business owners. If you draw part of your income from dividends in your business (above the £2,000 Dividend Tax allowance) you will see an increase in the amount of tax you have to pay.

If you’re a higher- or additional-rate taxpayer, this could have a significant impact on how much you can take from your business, with tax rates of 33.75% and 39.35% respectively.

What this means for the self-employed

If you’re self-employed you will arguably be hit harder than other workers, as you pay tax through self-assessment.

This means that your tax rate is determined by your income after business expenses. As a result, how much tax you pay will depend on how much you pay yourself.

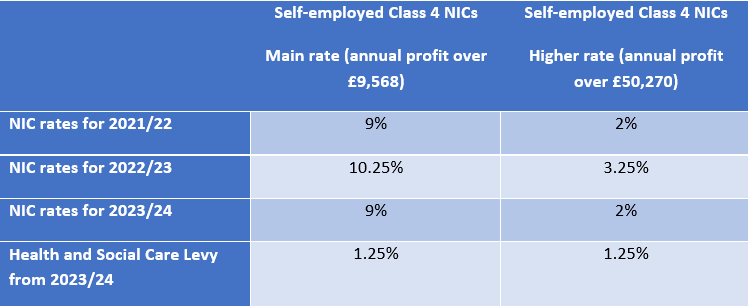

Self-employed workers pay Class 4 NICs, with the rates as shown below:

Source: Money Saving Expert

It’s worth noting that the NI rise will not apply to Class 2 contributions, where workers with annual earnings from £6,515 to £9,568 pay a rate of £3.05 a week.

Get in touch

If you’d like to find out how the Health and Social Care levy will impact you, either as an employee, an employer, or a self-employed worker, then please do get in touch with us.

Email info@depledgeswm.com or call 0161 8080200 to speak to one of our experienced advisers.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Tax rates are based on your individual circumstances. The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Comments on What the new Health and Social Care Levy means for you and your finances

There are 0 comments on What the new Health and Social Care Levy means for you and your finances