20/07/2022

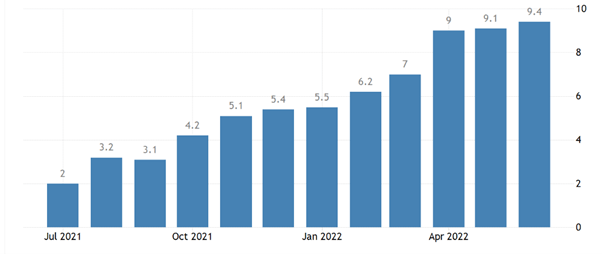

According to the Office for National Statistics (ONS), the UK’s rate of inflation now sits at a 40-year high, rising to 9.4% in June 2022.

Indeed, in light of the Covid-19 pandemic and the Russian invasion of Ukraine, the prices of everyday goods have skyrocketed in recent months. These factors have formed somewhat of a perfect storm that has brought on what is being described as the “cost of living crisis”.

The below graph shows how the UK’s inflation rate has increased in the year to each month on the X-axis.

Source: Trading Economics

As a consumer, you might already be feeling concerned about the rising cost of living, and how it will affect your financial viability now and in the future. Indeed, the Office for National Statistics (ONS) reports that around 77% of consumers feel “very or somewhat worried” about the cost of living crisis.

While shouldering the rising costs that contribute to high inflation, one thing you may not have considered is the concept of “inflationary psychology”, and how it could have a negative impact on your finances overall.

Here’s how inflationary psychology might affect you, and how to find alternatives while costs remain high.

Falling prey to inflationary psychology could contribute to the rising inflation rate

According to Investopedia, inflationary psychology is both easy to adopt and hard to shake.

The concept involves individuals overspending in anticipation of rising costs – and, in turn, contributing to prices soaring even higher.

Consider a scenario in which you have half a tank of petrol left in your car. As you drive past your local fuel station, you notice that petrol is more expensive today than it was yesterday.

So, although you wouldn’t usually fill up with half a tank left, you decide to pull in and top it up – by the time it’s empty, you think, the prices will have climbed even higher.

While this may seem like a logical strategy, this is a classic example of inflationary psychology at work. By thinking this way, you are inadvertently contributing to public overspending when prices are high, often leading suppliers to raise their prices further.

So, your short-term money-saving strategy might actually affect your finances in the long run – particularly if this plan is adopted by millions of people around the UK.

It’s easy to see why so many people fall into this mindset; when times are tight, often our financial decisions become emotional, too. If you’re acting out of the fear of scarcity, it makes sense that you might overspend when you don’t need to.

Luckily, once you notice yourself subscribing to inflationary psychology, there are steps you can take to unlearn the habit.

2 ways to avoid engaging with inflationary psychology

1. Budget for rising costs at the start of each month

It is easy to overspend when you know prices are rising by the day. But, as we mentioned earlier, inflationary psychology can actually hurt your finances in the long run – so, it’s important to consider other strategies for fighting rising costs.

If you have a budget for household essentials like fuel and food, it could be wise to factor price rises into your monthly estimates.

For example, according to heycar, the average cost of petrol was 162.75p a litre at the end of April 2022. As of 6 July, though, the average price of petrol stood at 191.36p a litre.

So, if you are budgeting for next month’s amenities, factoring in further price increases could be beneficial. That way, you are less likely to overspend at the start of the month, and may find affording your essentials easier as the weeks go by.

2. Create a long-term financial plan with the help of a professional

While the cost of living crisis has forced us all to focus on our day-to-day expenditure, your financial goals are only going to be achieved with a long-term plan.

Indeed, you could be tempted to make alterations to your plans, such as reducing your pension contributions, or cancelling financial protection policies you hold. This is understandable – if you’re under financial pressure, you might have a knee-jerk reaction, rather than considering this period of high inflation as a short-term issue that is bound to pass.

By working with us to align your day-to-day actions with your long-term financial goals, you could gain the peace of mind you need to weather the current inflation storm.

Plus, you could be less likely to form habits based on inflationary psychology, helping you to stay on-task, even when tempted to overspend.

Get in touch

If you feel you’re falling into an inflationary psychology mindset, or need guidance surrounding the cost of living crisis, get in touch.

We can cast a professional eye over your financial circumstances, and help you focus on your goals during uncertain times.

Email info@depledgeswm.com or call 0161 8080200.

Please note

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on What is “inflationary psychology” and how might it affect you this year?

There are 0 comments on What is “inflationary psychology” and how might it affect you this year?