2nd November 2023

“Money can’t buy happiness.” This is a phrase you have likely seen, and perhaps said, many times over the course of your life.

While whoever first coined the phrase may be correct in theory, research now shows that the link between wealth and wellbeing is actually very strong.

Indeed, we don’t often think about money and happiness as entities that affect each other. Yet the driving force behind your pursuit of wealth, besides the basic comfort of you and your loved ones, is likely to be happiness – whatever that means for you.

Keep reading to find out why prioritising your happiness when creating a financial plan could help you achieve your goals more easily, and how we can help.

Not many people know what makes them happiest. Do you?

According to the Aegon Financial Wellbeing Index, the happiest people split their lives between two core values: joy and purpose.

However, their research revealed that very few people can pinpoint the things in their life that contribute towards these two pillars of happiness. In fact, only 1 in 5 people are very aware of what brings them joy, and just 15% say they know what makes their life meaningful.

Interestingly, of the groups of people that Aegon polled for their research, retirees were most likely to be able to name what makes their lives enjoyable and meaningful.

Many people decide to wait until retirement to begin prioritising their own happiness – but if you’re still in your career years, waiting until you stop working to focus on your wellbeing could have both emotional and financial ramifications.

In our busy working schedules, and within the noise of the digital age, it would be understandable if you struggle to put your finger on what makes you happy. Nevertheless, doing so could help you define your goals, prioritise them, then begin striving to make them a reality.

Try thinking about:

- The experiences you’ve always dreamed of having, but have always put off until later

- The times at which you feel the most relaxed and at ease

- Your top three priorities for wellbeing, and how you usually achieve them.

With these elements as your foundation, you can begin building a plan for how to live a happier life, both now and in the future.

Having a clear vision of your future self might make you more financially disciplined

Not only can understanding what makes you happy bring you closer to changing your life for the better, but it can make you more financially disciplined too.

Indeed, a study published by the BBC shows that those who have a strong vision of their future self are more likely to be diligent savers.

A young researcher, Hal Hershfield, set out to discover whether a disconnection from our future selves correlates with a reluctance to save up for retirement – and the results were conclusive.

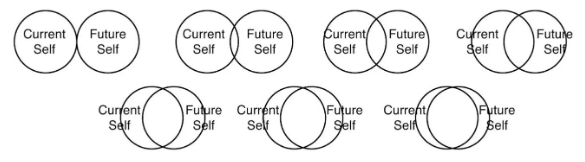

Using the below set of Venn diagrams, Hershfield asked participants to note down which one represented their relationship to their future self. Could they envision themselves clearly as 10 or 20 years older, or could they only focus on the here and now?

Source: BBC

After studying the results, Hershfield then looked at the savings each participant had amassed so far. He found that those who said they could picture their future selves easily had more saved than those who simply lived in the present.

The truth is, though, it can be challenging to picture yourself in the future if you’re unsure of what makes you happy. As such, the Aegon Financial Wellbeing Index found that only 28% of people have a clear image of their future self.

So, tapping into what brings you joy and purpose could be a great way to improve your vision for a more prosperous future. As the research shows, being able to picture a happy future in your mind’s eye might then motivate you to stick to your financial plan and pursue your long-term goals.

Working with an expert may empower you to do what makes you happy

While money can’t “buy happiness” in the most literal sense, many of the factors that contribute to your future happiness are likely to be financial.

These might include:

- Retiring or reducing your workload for the sake of your mental and physical health

- Gaining peace of mind in knowing that your family will be financially protected if the worst happened

- Knowing you have enough to pursue everything you want in life without putting your financial stability at risk.

As Hershfield observed in his research, without being able to pinpoint these factors now, you’re unlikely to have the financial discipline to achieve them later.

Fortunately, working with a financial planner can help you set your priorities in order. Financial planning encompasses more than just projections and spreadsheets – it puts your happiness, and the wellbeing of your family, at the heart of the conversation.

We can:

- Discuss your biggest priorities for happiness and wellbeing

- Hear your concerns about achieving or maintaining them

- Provide reassurance on the current volatility of markets, among other financial worries you may have

- Put a plan in place that centres around your and your family’s happiness

- Consistently review these plans while building a long-term relationship with you and your loved ones.

To create a financial plan that focuses primarily on your happiness, get in touch with us. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Wealth and happiness are inextricably linked. Here’s how

There are 0 comments on Wealth and happiness are inextricably linked. Here’s how