16th March 2021

While the coronavirus may have had a devastating impact on the health of the nation, it’s also resulted in one of the biggest economic shocks the country has ever experienced.

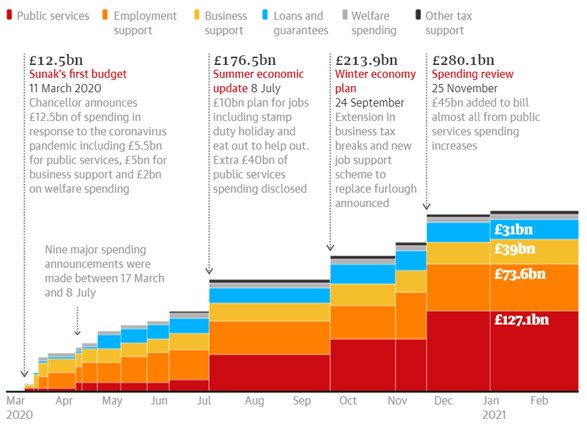

From falling tax revenues to increased public spending, the government’s economic response saw public sector net borrowing rise from £55 billion in March 2020 to a staggering £394 billion in November 2020.

Source: The Guardian

The cost of the response to the pandemic has been eye-watering, so read on for some of the headline figures.

The Coronavirus Job Retention Scheme

One of the government’s key responses to the challenges posed by the pandemic was to introduce the Coronavirus Job Retention Scheme, which has become known as the “furlough” scheme.

Under the scheme, the government committed to paying 80% of the wages of staff that employers had to furlough because businesses were unable to open or trade during lockdown or social distancing restrictions.

At its peak, the furlough scheme was supporting almost nine million jobs in the UK and, despite this number falling below three million in the autumn, there were still 4.7 million jobs furloughed as of 31 January 2021.

More than two-thirds (68%) of firms in the accommodation and food services sector were furloughing staff at the end of January. Arts, entertainment, and recreation had the second highest rate at 64%.

So far, the cost of the furlough scheme has reached £54 billion and rising. And, as the chancellor has announced the initiative will run until the end of September 2021, it’s expected at least another £10 billion or more will be added to the cost.

To give you a frame of reference, that’s more than the government spend on defence and the environment combined.

The Self-Employed Income Support Scheme

Aligned with the furlough scheme, the chancellor designed the Self-Employed Income Support Scheme (SEISS) to pay up to 80% of the profits of self-employed workers, averaged over the previous three years to a maximum of £2,500 per month.

While critics of the SEISS say that many people including the newly self-employed and limited company directors have fallen through cracks in the scheme, it has provided much needed support to business owners and entrepreneurs.

As of the end of January 2021, the government has spent £20 billion on grants for self-employed workers. And, with grants extended until September 2021, this figure will rise yet further.

Bounce Back loans, and other business help

As well as support for individuals, the government has provided support for business – particularly in sectors, such as leisure and hospitality, that have been hardest hit by lockdown restrictions.

- £31 billion has been provided in loans and guarantees, including the Bounce Back and Coronavirus Business Interruption Loan Schemes.

- Business rates relief has cost £10 billion.

- £12 billion has been provided in grants.

The biggest single cost is the anticipated future write-off of loans which the government has guaranteed.

In total, the Institute for Government say that £87 billion is expected to be loaned to businesses under three separate schemes. Of that, the government is expected to have to foot the bill for an eye-watering £31 billion that is expected never to be repaid.

Welfare

Additional welfare spending during the pandemic has cost £8 billion.

This is mainly because existing benefits have been made more generous. The most notable policy announcement was a £20-per-week increase in Universal Credit payments for eligible families.

Additional spending on public services

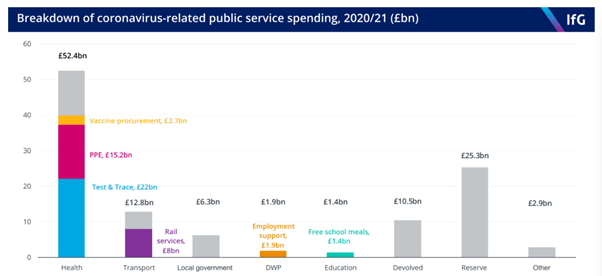

As well as supporting individuals and businesses through the pandemic, the government has also spent an extra £127 billion on virus-related public services.

Source: Institute for Government

Most of this £127 billion has been spent on health services, including spending on the Test and Trace system, and procuring additional personal protective equipment (PPE) for medical staff.

A substantial fraction of the money set aside for public services is in reserve. £25.3 billion is currently held in reserve in the expectation that many public services will need more before the end of this financial year.

Lower tax receipts

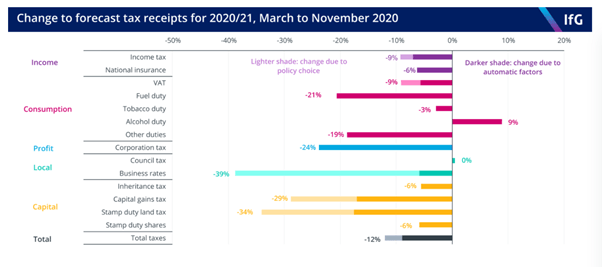

Of course, the financial hit to the Treasury isn’t just because of additional government spending. A contraction in GDP meant that tax revenues fell sharply in 2020.

Source: Institute for Government

The Institute for Government forecast that total tax revenues fell by around 12% between March and November 2020.

If you consider that the value of HMRC tax receipts for the UK amounted to approximately £635 billion in 2019/20, that’s a reduction in the tax take of around £76 billion. For context, that is roughly the amount the government spends on pre-primary, primary, and secondary education in a year.

The long-term costs of the pandemic

While the cost of coronavirus has already reached £300 billion, the long-term costs to the UK economy could significantly exceed this.

The costs discussed above are one-off events that have happened in the 2020/21 financial year. However, the pandemic could lead to long-term economic damage:

- Unemployed people lose skills

- Good businesses fail

- Businesses cancel investment.

These factors will also lead to long-term economic scars. Indeed, the Office for Budget Responsibility forecast that even in 2025, the UK economy will be 3% smaller than it otherwise would have been.

The cost to the public finances of the economy being permanently smaller by 3% per year is around £40 billion per year in today’s terms, mainly due to lower tax receipts.

Get in touch

If you have been affected by the pandemic and you want to review your finances, we can help. Please email info@depledgeswm.com or call (0161) 8080200.

![The staggering economic effect of the pandemic [in numbers]](https://www.depledgeswm.com/wp-content/uploads/2021/03/1-640x360.png)

Comments on The staggering economic effect of the pandemic [in numbers]

There are 0 comments on The staggering economic effect of the pandemic [in numbers]