10th November 2021

If you’re a higher- or additional-rate taxpayer, then one of the benefits of this is your ability to claim 40% or 45% tax relief on your pension contributions.

However, despite this superb tax benefit, new research published in the Telegraph (£) has revealed that 8 out of 10 higher-rate taxpayers eligible to claim this relief fail to do so – potentially costing thousands of pounds.

If this may affect you, here’s what you need to know and how you should claim the tax relief you’re entitled to.

8 in 10 higher-rate taxpayers not claiming additional pension tax relief

A Freedom of Information request seen by the Telegraph reveals that 8 in 10 higher-rate taxpayers who are eligible to claim pension tax relief through their tax returns fail to do so.

Meanwhile, more than half of all additional-rate taxpayers (those earning more than £150,000) did not claim the money they were due.

Calculations by PensionBee show that only 310,000 of 1.4 million higher- and additional-rate taxpayers claimed relief on their personal pensions in 2018/19.

Note that these figures do not include people who claim over the phone or online, or anyone who has received tax relief by making a “salary sacrifice” contribution.

Overall, the failure to claim this relief could be costing pension holders tens of millions of pounds.

Under the current rules (2021/22 tax year), higher-rate taxpayers – anyone earning over £50,000 per year – receive 40% tax relief. Additional-rate taxpayers – with an annual income over £150,000 – receive 45% tax relief.

Your pension provider will claim tax relief at the basic rate of 20% for you. If you are a higher-rate taxpayer, you can then claim back a further 20% through your self-assessment tax returns. Additional-rate taxpayers can claim back a further 25%.

Here’s an example. If you are a 40% taxpayer and you contributed £8,000 to your pension, you would typically receive basic-rate tax relief of £2,000. You could then claim an additional £2,000 tax relief, but only if you file a tax return.

How to claim back the additional tax relief if you’re a higher- or additional-rate taxpayer

To claim your pension tax relief through your self-assessment, you will need to do so online.

Proceed to the relevant section of your online tax return and state the exact amount of your pension contributions. This should be a gross calculation that includes your contributions and the basic-rate tax relief of 20%.

The Telegraph reports that “not doing this is one of the most common mistakes people make”.

Your tax relief will either be supplied as:

- A rebate at the end of the tax year

- A reduction in your tax liability

- A change to your tax code.

Alternatively, you can write to your HMRC tax office using the relevant address on your P60 or payslip. This letter should outline exactly how much you have paid in pension contributions, and you will also need to provide personal details so that you can receive the tax relief.

Remember that you will need to submit a new letter every time you change your pension contributions or your salary changes.

Important note

You can claim back tax relief from the previous four years. You must make your claim within four years of the end of the tax year you are claiming from.

Don’t forget about the Tapered Annual Allowance

If you’re an additional-rate taxpayer, the amount of tax relief you can receive may be affected by the Tapered Annual Allowance.

Each tax year, you can contribute 100% of your earnings to your pension tax-efficiently – up to a maximum contribution of £40,000. This is your Annual Allowance.

However, if your “threshold income” is over £200,000 in a year, or your “adjusted income” is more than £240,000, you may be affected by the taper.

The difference between “adjusted” and “threshold” income is simple. Your adjusted income includes all pension contributions (including any employer contributions) while your threshold income excludes pension contributions.

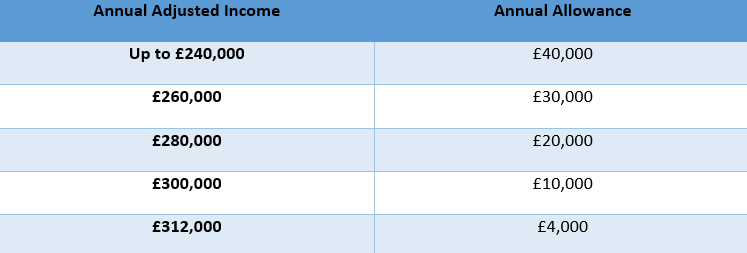

Under the taper, your Annual Allowance is reduced by £1 for every £2 of adjusted income over £240,000. If you earn £312,000 or more, you will have the maximum reduction of £36,000 – leaving you with an Annual Allowance of just £4,000.

The table below shows how the Annual Allowance tapers, based on how much you earn.

If you are affected by the Tapered Annual Allowance, it can be beneficial to work with a financial planner.

As the UK’s 2021 Retirement Adviser of the Year, we’re ideally placed to advise you on your pension options if you’re a higher earner. We can help you to maximise the tax efficiencies that are available and save for your retirement in the most effective way.

Get in touch

Want to find out more about saving tax-efficiently for your retirement? Get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Comments on The pension mistake that is costing high earners thousands

There are 0 comments on The pension mistake that is costing high earners thousands