14th December 2020

If you want to be able to live the life you want, now and in the future, working with a financial planner can be a great way to help you achieve this. And, as well as the clear financial benefits of working with a planner, research has shown that there are significant non-financial benefits too.

Studies have found that people who received financial advice were more confident, felt more in control of their finances, and were less likely to worry about their future. If you want to gain more peace of mind about your finances, read on to find out the non-financial benefits of financial advice.

Speaking to a financial planner can provide a greater sense of financial literacy

One of the biggest non-financial benefits that financial planning provides is a sense of financial literacy that many clients feel they gain through their interactions with their planner.

There are many technical terms in finance and facing a wall of jargon can sometimes make it difficult for you to feel that you are making properly informed decisions. This can be a source of undue stress, but is also one that is easy to fix.

Working with a financial planner can help you to become familiar with many of the technical terms and dispel any anxiety that the jargon may cause. This often translates into greater confidence and lower levels of stress.

A recent report by the International Longevity Centre (ILC) also found that the improved financial literacy from speaking to a financial planner had a marked difference in both men and women. Women who had received financial advice felt more empowered to make informed decisions, whereas the men felt more confident in trying new ways of investing their money.

Advised clients feel a greater sense of control over their finances

One of the ways that improved financial literacy benefits clients is by imparting a greater feeling of control in financial matters.

One of the reasons that some people are hesitant to seek the advice of a financial planner is a misplaced fear that they will no longer be in full control of their finances. However, working with a planner can in fact give you a greater feeling of security by enabling you to make informed decisions.

According to a 2012 study, 47% of people surveyed stated that they felt more in control of their finances than they did before they spoke to a financial planner.

Furthermore, increased financial literacy can give you peace of mind by reassuring you that you are managing your money in the most effective way possible.

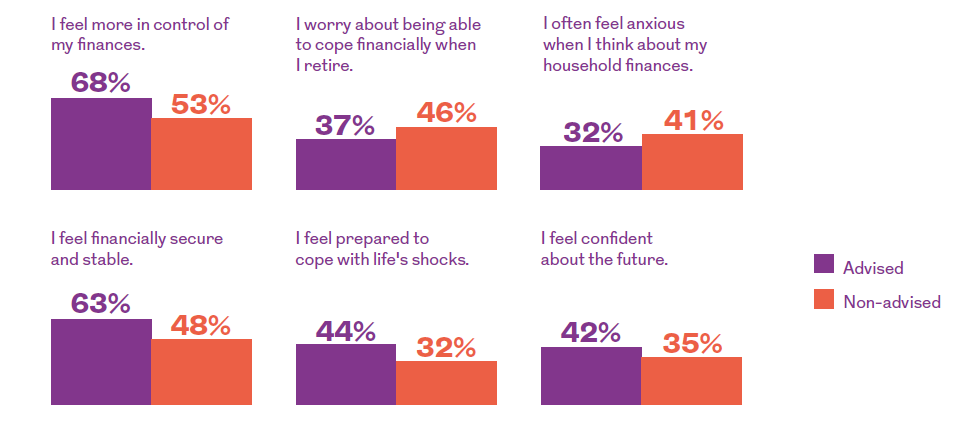

A recent study by Royal London considered the non-financial benefits of advice. They found that clients who received financial advice felt greater levels of control and confidence, as well as lower levels of anxiety, than those who did not.

Source: Royal London

Benefits are even greater if you speak to your planner regularly

Not only do studies show that speaking to a financial planner can improve your feelings of control, confidence, and financial literacy, but they also show that regular contact amplifies its effect.

If you know your planner well, or better yet speak to them on a regular basis, the emotional benefits you can receive are even greater.

Studies show that people who have an ongoing relationship with their financial planner felt greater benefits than those who had only sought one-off advice. Those with an ongoing relationship reported that they had greater feelings of control, as well as greater feelings of financial stability and confidence that they could withstand economic shocks.

These improved feelings of confidence and stability also translated into lower levels of anxiety regarding finances.

Furthermore, according to the study published by the ILC, clients who received ongoing advice said that it provided them with a sense of security and peace of mind, both generally and in uncertain times.

One explanation for this is that being able to speak to a financial planner helps to build trust faster and more firmly than with occasional or one-off meetings. The study found that clients who rarely see their planner tend to consider their interactions as being more transactional compared to clients who see them regularly.

This is significant, as trustworthiness was considered to be one of the most valued traits when choosing a financial planner, with 81% of people surveyed describing it as important.

Speaking to a financial planner regularly can help to build trust, which amplifies the non-financial benefits that the relationship can bring. Greater levels of trust in your financial planner can bring greater assurance that your money is being used in the most effective way and that your future is in safe hands.

Get in touch

If you want to reap the financial and emotional benefits that speaking to a financial planner can bring, we can help. Email info@depledgeswm.com or call (0161) 8080200.

Comments on Revealed: The non-financial benefits of financial advice

There are 0 comments on Revealed: The non-financial benefits of financial advice