16 January 2024

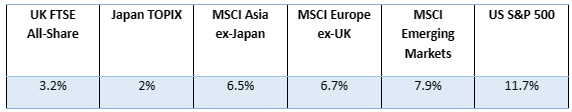

At the end of Q3 2023, all six of the below indices posted negative returns.

Fortunately, by the end of the final quarter of 2023, those same indices had all experienced a U-turn and were seeing positive results across the board.

Source: JP Morgan

After the stock market ended 2023 on a high, you could be wondering: why did markets rally in December, and will this continue into 2024?

Keep reading to learn the details from the UK, US, eurozone and Asia.

UK

One hugely important factor that influenced UK markets throughout 2023 is inflation.

According to the Office for National Statistics (ONS), UK inflation slowed to 3.9% in the year to November 2023, down from 4.6% in October.

In response to the ease in the rate of inflation, the Bank of England (BoE) chose to fix the base rate at 5.25% between August and December, where it has remained until the time of writing (January 2024). As a result, investors may have been reassured that the BoE did not continue to raise the base rate as it had done since December 2021 (although some may not consider 5.25% a sustainable rate over the long term).

Overall, these two factors ignited positivity among consumers and investors alike.

Coupled with this was Jeremy Hunt’s ‘Autumn Statement for growth’. The chancellor set out measures to make Individual Savings Accounts (ISAs) more flexible, continue the 75% business rates discount for another year, and cut National Insurance – all of which may have contributed to the positive sentiment reflected in Q4’s market performance.

That said, this positivity is temperate. The UK FTSE All-Share index posted just 3.2% at the end of December – and while this is an improvement on Q3, which returned 1.9%, this somewhat pales in comparison to the US S&P 500, which saw an 11.7% return.

Nevertheless, progress is evident, especially when we look back at the figures from the previous year. The UK FTSE All-Share ended 2023 on 7.9%, compared to just 0.3% at the end of 2022.

US

As you read in the above section, the S&P 500 returned 11.7% in Q4 2023, and saw a 26.3% gain across the whole year – an astonishing uptick from its -18.1% downswing in 2022.

This turning of the tide may have a lot to do with inflation and interest rates. According to Reuters, US inflation grew much more slowly in Q4 than it had done since before the pandemic, rising to below 3% in November 2023.

In addition to this, the JP Morgan report notes that the December Federal Open Market Committee meeting from Q4 produced a forecast of three interest rate cuts from the Federal Reserve (Fed) in 2024. You can read a little more about what this could mean for asset values in our latest blog surrounding predictions for 2024 market movements.

What’s more, as a result of the Fed’s interest rate hike pauses, and the anticipation of further cuts, fixed income holdings picked up across the board in Q4. After a long period of decline for bonds, stock and bond values are now increasing simultaneously, so many forecasters predict a bumper year for US markets.

This being said, the US is due a general election in November 2024, an event which could cause volatility in the stock market. While the upcoming election may not dampen your investment plans, it may be wise to anticipate some market shocks if you are planning to liquidate US shares this year, for example.

Eurozone

According to a eurostat report, eurozone inflation grew to just 2.4% in November 2023, down from 2.9% in October 2023 and 10.6% in October 2022.

Indeed, the 6.7% gain made by the MSCI Europe ex-UK index in Q4 signals that, much like in the UK and US, slowing inflation has been welcome news to investors. What’s more, the index closed out the year on a 17.3% return, after falling to -12.2% in 2022.

The expectation of interest rate cuts in 2024 has also been a catalyst for investor action, helping to rally European asset values towards the end of 2023.

However, Schroders reports that the European energy sector “underperformed” in November due to stagnating energy prices and decreasing demand.

As the year progresses, it could be that European share prices continue to rise – although the ongoing war in Ukraine means that further instability could be on the cards too.

Asia

Chinese equities fell in Q4 2023, largely due to concerns around a lack of economic growth. On the other hand, the surrounding nations (except Japan) picked up the slack, boosting the MSCI Asia ex-Japan index to 6.5% in Q4 and offering a 6.3% return over the whole year. In 2022, the index returned -19.4%.

Conversely to the exponential growth in Japan throughout 2023, the Japan TOPIX returned only 2% in Q4 2023. The index still performed impressively over the year, though, seeing a 28.3% gain largely due to the thriving technology sector. The same index saw a negative return of -2.5% in 2022.

Get in touch to find out how professional investment planning could help you achieve your goals

As you can see, despite some fluctuations, 2023 saw markets rally from the significant downturns experienced in 2022. Some forecasters suggest that 2024 will see an even bigger upswing, leading to the first bull market since Q1 2020.

No matter which way markets move, seeking expert advice could transform how you invest. Working with a financial planner can help you to align your investments with your life goals, taking your appetite for risk, desired time frame, and wider market conditions into account.

Email info@depledgeswm.com or call 0161 8080200 to get started.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Q4 2023 global market update

There are 0 comments on Q4 2023 global market update