2nd November 2023

After the continued market shocks that rocked investors’ confidence throughout 2022, the first half of 2023 brought some welcome relief.

As we reported in our Q2 global market update, a number of key stock market indices posted positive returns in June – but for the most part, this uptick was brief. Nevertheless, the overall outlook for 2023 still seems far more positive than in 2022, despite the fluctuations you’ll read about here.

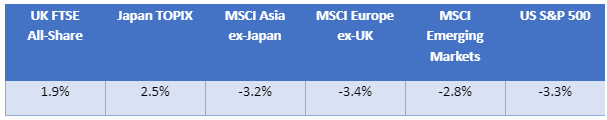

Indeed, many indices are still experiencing volatility, which led to downturns in the period between June and September 2023. The below table shows the dips – which you’ll notice that the UK avoided overall – experienced in Q3.

Source: JP Morgan

Keep reading to learn more about the factors that contributed to these market movements, and what this could mean for your investment portfolio.

UK

After posting negative returns last quarter, while the US, European and Asian indices mostly reported positive growth, these roles have now been reversed.

Indeed, the UK FTSE All-Share index reported a 1.9% uptick in Q3, bringing some peace of mind to investors in British holdings. However, the index had given up most of these gains by late October, showing less promise for its Q4 performance.

One factor that could have contributed to the growth experienced in Q3 is the Bank of England (BoE) base rate, which the Monetary Policy Committee (MPC) elected to maintain at 5.25% across August and September, rather than implementing yet another hike.

This freeze comes in the wake of a slowly declining inflation rate – the Office for National Statistics (ONS) reports that inflation had fallen to 6.8% by July, and maintained a rate of 6.7% in August and September.

As the inflationary conditions we’ve experienced have continued to force the BoE’s hand when it comes to interest rates, the slowing of these two elements is likely to have strengthened consumer confidence until September, but this progress does not appear to have held steady in October.

Since then, though, the ONS has reported that inflation fell sharply to 4.6% in October, signalling that better times could be ahead where the cost of living is concerned.

Additionally, a sharp rise in oil prices helped bolster the UK’s energy sector, JP Morgan reports.

As the chancellor’s Autumn Statement approaches – it is set to be delivered on 22 November 2023 – it is yet unclear what new fiscal announcements may be made, and the effect these could have on markets in Q4.

We’ll be publishing a full report on the Statement shortly after it’s delivered, so keep an eye on your inbox for all the up-to-date information about this speech when it happens.

US

After posting an 8.7% return at the end of Q2, the US S&P 500 declined again in Q3, ending the quarter 3.3% lower. However, in the six months to October 2023, the index rose by around 4%, indicating promising progress overall despite short-term fluctuations.

By September, the Federal Reserve (Fed) had kept central interest rates between 5% and 5.25%, which Trading Economics reports is a 22-year high for the country.

While US consumers may have entered the quarter hoping that these rates would be reduced, these hopes clearly waned by September, and the reality may have begun to sink in: interest rates are unlikely to ease significantly until inflation is fully under control.

What’s more, Schroders reports that US unemployment is up by 0.3%, bringing the number of unemployed Americans to 6.4 million. While a seemingly meagre rise, this could have contributed to investors’ enthusiasm becoming depleted over the quarter.

Eurozone

Although inflation slowed from 5.2% to 4.3% between August and September, Trading Economics reports, the eurozone’s consistently high interest rates have had a knock-on effect on markets in this period. Happily, though, eurozone inflation dropped to 2.9% in October, which could build investors’ confidence moving forward.

While the European Central Bank (ECB) could now begin to freeze or reduce interest rates, for now consumers are still faced with a rate of around 4.75%.

With little disposable income and post-pandemic excitement beginning to weaken, combined with the ongoing Ukraine war, consumers in the eurozone may be feeling understandably pessimistic about the region’s financial outlook.

While consumer tourism may have bolstered the economy over the summer, the MSCI Europe ex-UK, which covers 344 constituents in 14 developed markets, dipped by 3.4% in Q3. However, when we look at the wider picture, the index gained an impressive 10% in the first nine months of this year.

Plus, Schroders reports that although most European sectors dipped in Q3, energy performed well as oil prices rose due to some exporting countries reducing production.

Asia

The MSCI Asia (excluding Japan) also ended Q3 negatively, down by 3.2%.

Concerns over the relationship between China and Taiwan, and Chinese inflation dipping to -1.5% by September 2023, Statista reports, meant that the outlook for Asian markets has remained unstable throughout the second and third quarters of this year.

In South Korea, factory output has slowed and consumer spending fell, contributing to a weakened position for the region overall.

Meanwhile, the Japan TOPIX returned 2.5% in Q3 – and over the course of 2023, it has gained 25.7% overall. While interest rates have continued to rise, affecting large growth stocks, small stocks and value stocks proved resilient. What’s more, consumer confidence in Japan’s technology sector has seen stock prices boom since March, and while interest rate hikes might have dampened this somewhat, the momentum behind the sector is still present.

No matter the short-term fluctuations affecting your portfolio, we can help you focus on your long-term goals

Investing is a long-term endeavour, so although global market uncertainty can be worrying at times, history reassures us that markets usually recover.

With this in mind, it could help to discuss your portfolio with a financial planner before taking any action as a result of downswings your investments are seeing. Sometimes the best action is actually to do nothing, especially if you’re planning to hold your investments over a long-term period.

Get in touch

To learn more about how our financial planners can help you manage your investment portfolio, get in touch today. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Q3 2023 global market update

There are 0 comments on Q3 2023 global market update