14th September 2021

The recent record A-Level results saw 44.3% of entries obtain a grade A or above. This terrific success means that more than 210,000 18-year-old students in England have had their university places confirmed already.

Heading off to university can be a fulfilling and enriching experience – but these days it doesn’t come cheap. With many courses costing £9,250 a year, and living expenses on top of that, it’s not unusual to see students exit university with tens of thousands of pounds of debt.

Indeed, new Opinium research has revealed that both parents and students both underestimate student debt. Read on to find out more, and how investing early can help you to build up a fund for your child or grandchild.

Parents and students underestimating student debt

A new study from the Association of Investment Companies (AIC) has found that both parents and students underestimate the amount of debt that going to university will result in.

Students planning to go to university expect they will finish their course with average debt of £37,803. This is close to the debt burden anticipated by students in their final year of university (£36,943).

However, the average parent expects their children to leave university with debt of £24,852.

All these estimates fall short of official figures, which indicate the average debt of a student who finished their course in 2020 is £45,000.

Annabel Brodie-Smith, communications director of the Association of Investment Companies (AIC), said: “Despite the huge impact of the pandemic on students’ university experience, going to university is still a key aspiration for thousands of young people across the country.

“However, students and parents are both underestimating the average amount of student debt on graduation with parents particularly wide of the mark.”

In 2021/22, the tuition fee for UK universities is £9,250 a year, meaning a student loan for a three-year degree would be £27,750. In addition to this, maintenance loans are available to cover living costs, and these are means-tested based on household income.

In 2021/22, if your household has an income of more than £70,000 a year, the maintenance loan available will be £3,516 a year if the student lives at home, or £4,422 if they live away from home. If they study in London the loan is £6,166 a year.

So, a child or grandchild on a three-year course living away from home could easily graduate with a debt of more than £40,000.

Investing could help you to generate a fund to pay for university costs

While the AIC research found that many parents and grandparents are saving for a child’s future, they are much more likely to use cash savings accounts than invest in the stock market.

59% of parents use cash accounts, compared to 16% who use investment companies and 15% who invest in shares.

The official data backs this up. The latest government statistics say that £974 million was subscribed to Junior ISA accounts in 2018/19, around 57% of which was in cash.

Given that the stock market tends to outperform cash over a long period, if you start saving when the child is young, returns over an 18-year period could be significant by the time your child or grandchild heads off to university.

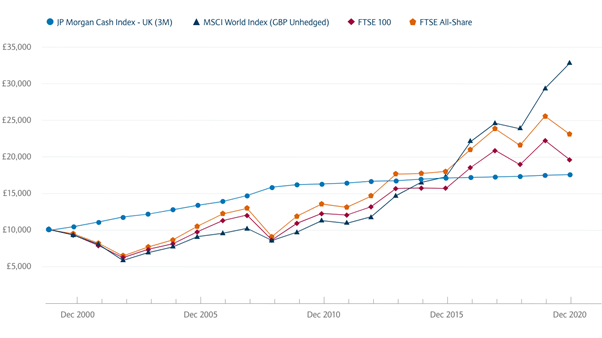

Below is a graph from Barclays, indicating what might have happened by 31 December 2020 to a £10,000 investment made in January 2000. Remember that past performance of an investment is not indicative of the future.

Source: Barclays. Notes: Cash is the JP Morgan Cash Index UK (3M), developed market shares are represented by the MSCI World Index (GBP unhedged), UK Large Cap shares are represented by the FTSE 100, UK Shares are represented by the FTSE All-Share. All returns other than cash are gross of fees (so do not include a deduction for charges).

It shows that, over this 20-year period, investing would have generated a better return than leaving your money in cash.

So, had you begun investing for your child or grandchild 18 years ago, it’s likely that you would have a larger university fund now than if you had kept the money in cash – even in a Cash ISA.

Do I pay off a student loan or gift the money to my child/grandchild?

If you’ve saved a significant sum for your child or grandchild – perhaps in a Junior ISA – your first thought might be that you want to pay off their student loans. This could help them to get a solid start to their career, with no debt hanging over them.

However, as we have written about before, this may not be the best idea.

Students only begin to pay back their loans when they earn above a certain threshold income (typically £27,295 in the 2021/22 tax year).

For example, if your child or grandchild graduates this year and get a job paying £30,000 a year, they will normally only be required to repay 9% of their income above the threshold (£2,705) each year.

Assuming nothing changes, this means they will only repay around £243 a year, or around £7,300 after 30 years. At this time the outstanding loan – which could be £30,000 or more – would be written off.

In this situation, it may actually be more beneficial to provide the lump sum to your child as a gift. Using it as the deposit for a home, or to set up a business, could actually be a more sensible decision than simply paying off their loan.

Get in touch

If you want to build up savings for your child or grandchild to help them with their university costs, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on Parents underestimating student debt by nearly 50%

There are 0 comments on Parents underestimating student debt by nearly 50%