Over the last two decades, emerging markets have been attractive to investors and investment strategies have followed an ever globalising trend. High growth rates in developing nations have meant that large profits have been generated in riskier assets outside of the more stable markets that have long dominated global economics.

Often double-digit growth in the BRIC nations – Brazil, Russia, India and China – has seen wilful investors reap great profits through investing in countries with plentiful opportunities, which often carry a higher degree of risk.

However, despite the fact that emerging markets have generally matured, they are still subject to exaggerated economic cycles where both ascents and downturns are amplified. Over the past months, certain emerging markets have suffered and their fragility has been revealed.

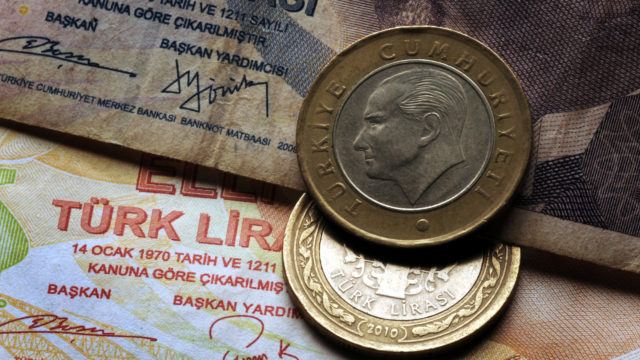

Recent events in Turkey and Argentina have served as a reminder of just how vulnerable developing economies are to violent shocks.

Stubborn political tactics by Turkey’s President Erdogan have caused market commentators to worry that he threatens the country’s economic stability.

In the run-up to elections, Erdogan kept interest rates incredibly low – too low in fact, to contain Turkey’s rocketing inflation. This caused the lira to plummet and placed Turkey on the brink of financial crisis.

Unsurprisingly, Erdogan – who has dominated national life for 15 years – was sworn in again in early July. His leadership worries many investors because his relentless drive for economic growth has seen Turkey’s debt levels soar.

What’s more, upon re-election, the populist leader handed the job of economic chief to his son-in-law, a clear sign that he is unwilling to adopt a responsible economic strategy any time soon.

A weak currency has also been a factor in Argentina’s recent economic turmoil. Over the past year, the peso has lost a quarter of its value against the dollar and is at a record low. Interest rates have risen to an alarming 40%, stifling development throughout the country.

Should these events be cause for alarm? The short answer is “not really”. What they highlight is the importance of assessing a local political situation when making investment choices. Political shocks can cause massive volatility in emerging markets, which are less resilient than those of developed countries.

Elsewhere, developing economies have been performing incredibly well. Brazil, propelled by rising oil prices, has emerged from a two-year recession as a buoyant opportunity for investors. Even Argentina, despite its recent economic woes, has a government unanimously praised among international investors for ending a long period of capital controls and re-establishing trust in Argentine economic data.

Investments in countries with governments that react quickly to externally driven economic deterioration are favourable. Here, a downturn in prices can even provide sharp investors with attractive buying opportunities.

However, investors should take a measured approach when investing in weaker emerging markets. Exaggerated movements are commonplace, so the potential for extreme volatility should be taken into account.

It is important to be mindful of the additional implications of investing in emerging markets if you choose to do so. Keeping a close eye on the local political context should always be on your agenda.

Changes in the rates of exchange between currencies may cause your investment/the income to go down or up.

Comments on Is recent instability a cause for alarm for emerging market investors?

There are 0 comments on Is recent instability a cause for alarm for emerging market investors?