17 August 2023

In a bid to gain popularity before the next general election, which is set to happen before January 2025, some senior Conservatives have launched a campaign to scrap Inheritance Tax (IHT).

Launched in 1986 to replace Capital Transfer Tax, which essentially held the same function as IHT, the tax has existed in various forms for many decades. IHT exists to prevent large estates from being passed down to the next generation in full.

According to a report from FTAdviser, more than 50 MPs have joined the campaign to remove IHT and allow families to pass their wealth down tax-free.

Former chancellor Nadhim Zahawi called IHT “the other spectre that haunts us alongside death”, while former business secretary Jacob Rees-Mogg calls the tax “unfair” and “economically damaging”.

In opposition, political commentator Paul Johnson writes for the Institute for Fiscal Studies (IFS) that “inheritance is one of the drivers of falling social mobility”, calling for the tax to remain in place.

So: will IHT be for the chopping block after the next election, and how could this affect your family’s financial situation moving forward? Read on to find out more.

Current Inheritance Tax rules mean a portion of your estate may go straight to HMRC when you die

Under existing IHT rules, some of your wealth may be subject to a tax charge when you pass away.

Spouses and civil partners generally don’t pay IHT, but any other beneficiary can receive a bill upon receiving your estate.

Fortunately, there is a set amount that each person can leave to the next generation that won’t attract IHT.

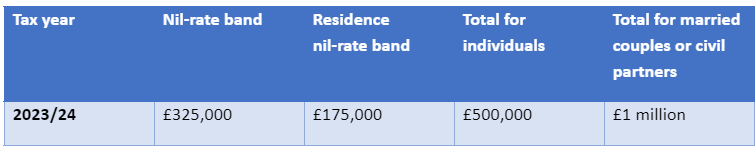

The nil-rate band marks out how much a person can pass down without attracting an IHT bill. There is an additional relief for property passed to direct descendants, called the residence nil-rate band.

As of 2023/24, the nil-rate bands are as follows:

Source: HMRC

For example, if you individually passed down £600,000 in assets (including your home) to your children, £100,000 of this would likely be subject to an IHT charge.

Importantly, the nil-rate bands have been frozen at their current rates until 2028. According to Money Marketing, these freezes have caused IHT receipts to soar – in April 2023, HMRC took £600 million, a £100 million increase on the previous year.

Moreover, if your estate increases in value in the coming five years, your family’s IHT bill may rise too if you were to pass away.

Scrapping Inheritance Tax could mean wealthy families can pass their entire estate on to the next generation

In light of rising IHT receipts, the idea that IHT could be vastly reduced or abolished in the coming years may be exciting to you.

In a world without IHT, you could expand your wealth without the concern of a tax charge down the line. This does not mean that your estate would exist tax-free, but it could allow you to pass the majority of your wealth down to your children and grandchildren without losing a percentage to tax.

Here are two aspects of financial planning your family could reflect on if IHT were scrapped.

1. Gifting money and property to the next generation

Under 2023/24 IHT rules, if you gift more than your annual exemption of £3,000 and pass away within seven years of the transfer, the remaining amount could be subject to IHT.

This is known as a “potentially exempt transfer” (PET) and makes giving large cash or property gifts taxable in some circumstances.

Without IHT, though, you could give your assets freely to the next generation.

Saying this, other forms of tax would still apply – for instance, if you cashed in shares to help a child onto the property ladder, you may still pay Capital Gains Tax (CGT).

Nevertheless, the ability to pass your wealth down more tax-efficiently, either now or when you die, might improve your peace of mind as you age.

2. Investing more outside of your pension

As of 2023/24, your pensions do not usually form part of your estate for IHT purposes.

So, you can normally pass your pension wealth down without IHT – and for that reason, many people stay invested within their pension for as long as they can.

If the Conservatives decide to axe IHT, though, this may present further opportunities to invest outside of your pension, even in retirement.

While many people design their investment portfolio to mature in retirement, this shift could mean your portfolio can be inherited tax-efficiently.

As such, you could decide to take some income from investments to support your retirement lifestyle, while also keeping a portion of your portfolio invested to benefit the next generation.

A financial planner can help you adapt to government decisions that affect your wealth

The truth is: the Conservatives may decide to keep IHT in place after all. And, if Labour win the election, this might not be a priority for them.

Regardless of what a new administration decides in this instance, though, there will always be factors outside of your control that have an impact on your money.

That’s where expert advice can be so powerful: we can help you form a robust financial plan that enables you to adapt to changes when they happen. If new challenges or opportunities emerge, we will be ready and waiting to help you make the most of them.

To learn more about tax-efficient estate planning, or to discuss anything else you’ve read about here, email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate estate planning and tax planning.

Investments carry risks. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Comments on Is Inheritance Tax heading for the chopping block? Here’s what you should know

There are 0 comments on Is Inheritance Tax heading for the chopping block? Here’s what you should know