26th April 2021

Did you know the price of cheese increased by 150% between 1987 and 2014?

During our working life, inflation may not affect us (other than the odd “how much?!” moment when we’re out shopping). Our wages and earnings typically rise in line with inflation, so we generally keep up with the cost of living.

Once you retire, it could be a different matter. Maintaining your lifestyle as inflation makes things more expensive can be tricky, so here’s what you need to know about the risks that inflation poses to your retirement.

Inflation can have a serious effect on your buying power in retirement

Inflation may not sound like the most serious of risks to your future lifestyle. Yes, you might know that prices tend to rise slightly each year, but that shouldn’t adversely affect your standard of living, should it?

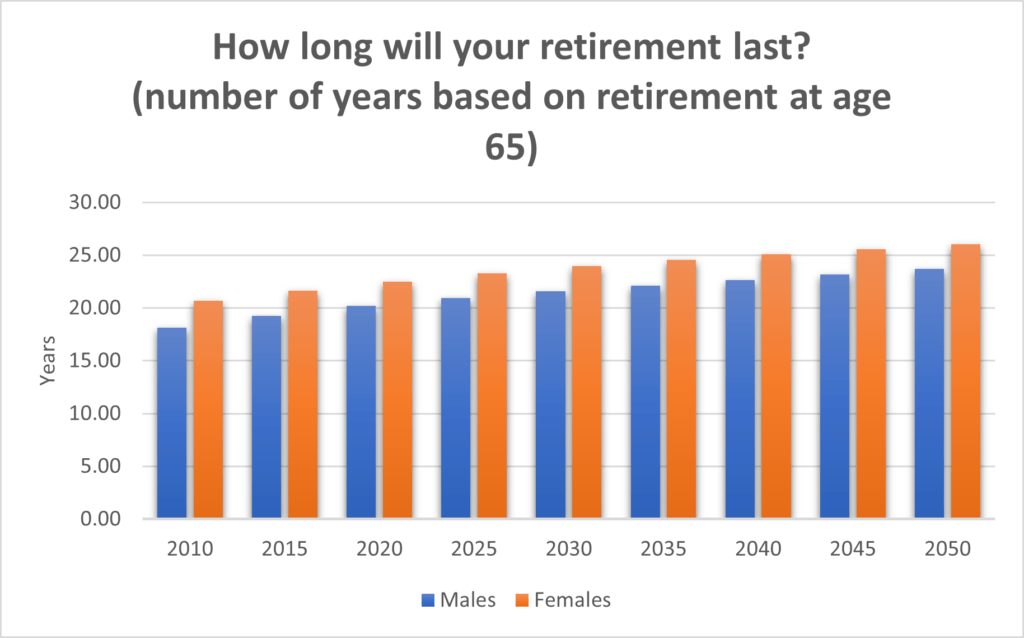

A few decades ago, retiring at 65 meant your pension might have to last you, if you were lucky, ten or fifteen years. Now, if you retire at 55 you could easily find that your savings have to last you 30, 40 or even 50 years.

Office for National Statistics data shows that, by 2030, the average 65-year-old man can expect to live more than 20 years beyond a retirement age of 65. The average woman can expect to live almost 25 years.

Source: ONS

If your retirement income is going to have to last you two decades or more, it follows that your spending power is not going to be the same in the future as it is today – thanks to inflation.

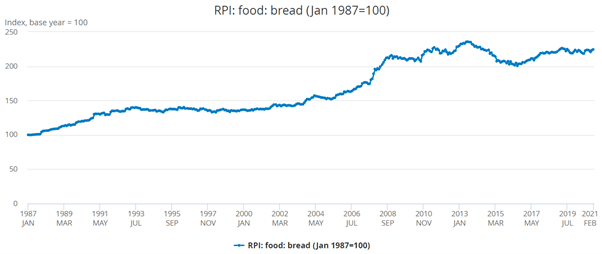

Here’s an example using the humble loaf of bread.

Source: ONS

In the 20 years to May 2008, the cost of a loaf of bread doubled. Unless your income had also doubled in that time, you’d potentially be in a worse position two decades into your retirement than you were the day after you finished work.

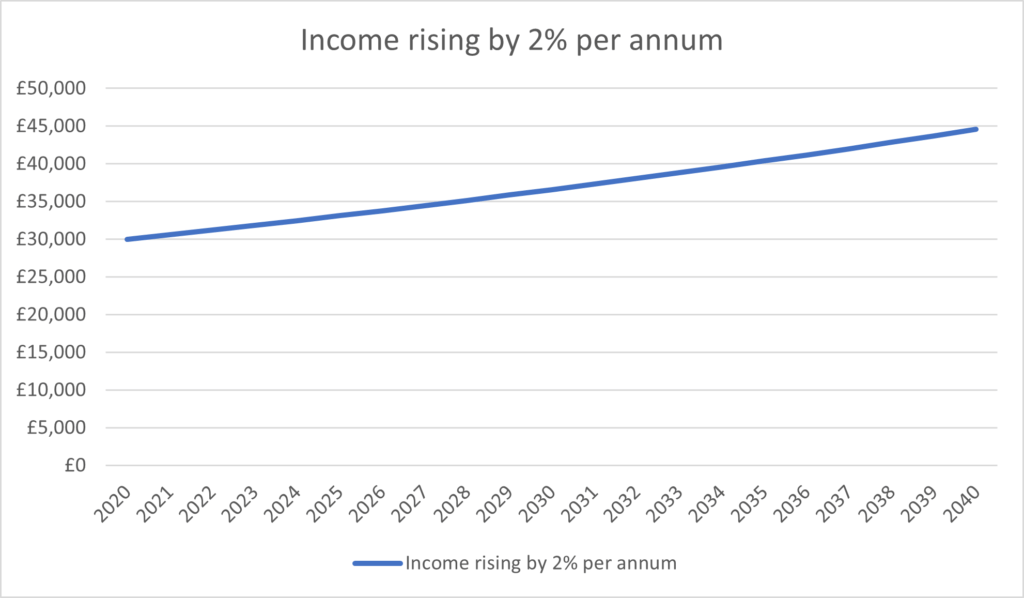

The simple fact is that, if inflation were to remain at the Bank of England’s target of 2% for the next 20 years, your money will end up worth about two-thirds of its current value. In 40 years, its value will have halved.

Let’s take an example of an income of £30,000 a year. In year two, assuming a 2% inflation rate, your income would need to be 2% higher – £30,600 – to keep pace with inflation. In year three, it would need to be £31,212. And so on.

By the end of year 20, your income would need to be £44,578 just to keep pace with a 2% annual rise in the cost of living.

Calculations from thecalculatorsite.com

Of course, this only accounts for expected inflation at the Bank of England’s target of 2% a year. If inflation is higher than this target, then your income will need to rise even faster to keep pace with the cost of living.

Remember that some of your retirement income will be inflation-proof

When you retire, some of your income may be inflation-proof – i.e., will rise annually in line with the cost of living.

For example, the State Pension “triple lock” ensures that, for now, the State Pension increases each year by the highest of:

- Inflation

- Average earnings growth

- 2.5%

So, your State Pension should provide some inflation-proof income. Read our useful blog to find out more about the role the State Pension could play in your retirement income.

Also, if any of your retirement income is coming from a defined benefit (final salary) pension, then you may also expect it to rise annually in line with the cost of living.

Two other ways to deal with inflation risks in retirement

One traditional way that many retirees have turned their pension fund into a guaranteed, inflation-proofed income is through an annuity.

Here, you exchange part or all of your pension pot for a guaranteed income, which can rise each year to keep pace with inflation. You can also choose other benefits with an annuity, such as whether you want the income to continue to be paid to a spouse or partner after your death.

Remember that you can’t normally change or cancel an annuity once it’s established, so it’s important to take advice regarding your options.

A higher-risk option is to keep your pension fund invested and mitigate the inflationary risk through investment performance. Historically, equities have provided solid, inflation-beating long-term returns and have outperformed cash and other asset classes.

Of course, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Using drawdown, you can usually take up to 25% of your pension fund as a tax-free cash lump sum, then you would typically keep the rest of your pension invested and draw an income as required. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

This may be in addition to a cash buffer from which you can continue to pay for your day-to-day outgoings without having to sell investments in poor market conditions.

Again, taking advice as you approach retirement can be hugely beneficial. We can help you to put a strategy in place to draw income tax-efficiently, and to ensure you can maintain your lifestyle in future years – however the inflation rate affects your spending power.

Email info@depledgeswm.com or call (0161) 8080200.

Please note

Investments should be regarded over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Comments on Inflation and retirement – why rises in the cost of living really matter when you retire

There are 0 comments on Inflation and retirement – why rises in the cost of living really matter when you retire