18th January 2022

You’ve probably seen the recent headlines that inflation has reached its highest level in a decade. The BBC reports that the cost of living rose by more than 5% in the year to November 2021, driven by higher transport and energy costs.

With experts predicting that inflation could rise even further in 2022, how can you ensure that your wealth retains its value in real terms?

One way is to ensure that you don’t hold more than you need to in cash deposit accounts. Read on to find out why.

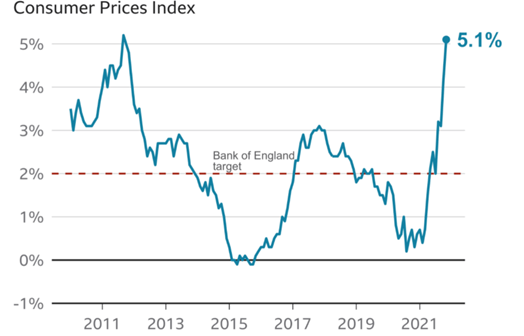

Inflation has reached its highest level since 2011

Since the UK economy reopened after lockdown, many businesses have struggled to keep up with a surge in consumer demand. Global supply chain shortages, staff isolating due to the so-called “pingdemic”, issues relating to Brexit, and rising gas and oil prices have exacerbated this problem.

All this means that the cost of living rose by 5.1% in the 12 months to November, up from 4.2% the month before. Inflation is now at its highest level since September 2011.

Source: BBC (with figures from the Office for National Statistics)

Simply put, a year ago your £100 would have bought you £100 of goods and services. Today, that same money would only buy around £95 worth of goods and services. In real terms, your money has lost value.

Interest rates remain at record lows

To combat rising inflation, the Bank of England decided to raise interest rates in December, from 0.1% to 0.25%. The theory is that raising rates encourages consumers to save rather than spend, curtailing demand and driving down inflation.

Despite this rise, interest rates on cash savings remain at record lows. As of 11 January, financial comparison site Moneyfacts reveal that the best easy access savings account pays just 0.7% interest – that’s just £70 a year for every £10,000 you save.

If you are prepared to tie your money up for between one and five years then it is possible to benefit from a higher rate, with some providers offering above 2% on a five-year bond.

However, even these higher rates of interest are nowhere near the rate of inflation. So, by leaving your money in cash, it is losing value in real terms.

This is especially true if you don’t shop around when it comes to your savings. Many popular high street savings accounts, such as Santander’s Everyday Saver and NatWest’s Instant Saver pay an interest rate of just 0.01%. That is £1 interest a year for every £10,000 you save.

A quick note about cash savings

While money held on deposit is unlikely to keep pace with cost of living rises, it’s important to retain some savings in an easy access account.

Holding an emergency fund – perhaps containing between three- and six-months’ expenditure – is a sensible way to ensure you have access to cash if you need it. It can also provide peace of mind that you have a safety net if you ever need one.

Additionally, if you are approaching or at retirement, it can often be sensible to retain a sum in cash.

If markets were to fall just as you wanted to draw money from your pension fund, using cash and delaying this drawdown until markets recover can be a sensible strategy to ensure your pension pot can sustain you throughout your retirement.

Investing your money could be one way to ensure it retains its value

As we have seen, holding large sums in cash can be detrimental to your long-term wealth. Indeed, the UK regulator, the Financial Conduct Authority (FCA), even has its own targets for reducing the number of consumers who hold large sums in cash.

The FCA say that there are almost 8.6 million consumers holding more than £10,000 of investible cash, and they would like to reduce this number by a fifth by 2025.

Investing your money can be one way of ensuring its value keeps pace with inflation.

- The MSCI World Index – a basket of more than 1,500 shares from developed markets across the globe – has generated an average annual return of 12.22% over the last decade.

- Looking at the UK, with dividends reinvested, the FTSE All-Share grew 140.37% in the 20 years to January 2021. This would have turned an initial investment of £10,000 into £24,037.

Of course, past performance is not a guide to future returns. However, in the long term, investing has typically generated superior returns than cash deposits, helping your money to retain its real value.

A final note about “risk”

Clients are sometimes wary of the “risk” involved in investing their money. Naturally, risk and return are often linked, meaning you tend to have to take more risk to pursue greater returns.

However, it’s worth briefly thinking about the “risk” of leaving your money in cash savings. By doing so, it’s likely that your money will lose its value in real terms. So, there’s a very real risk to your wealth by taking this approach.

However, note that investments carry risk and do not provide the same capital security as deposits.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Get in touch

If you are concerned about rising inflation, or you’d like to look at ways of inflation-proofing your wealth, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Comments on How to tackle the impact of inflation on your cash savings this year

There are 0 comments on How to tackle the impact of inflation on your cash savings this year