17 August 2023

Inflation has spiked in recent times, with the rate standing at 6.8% as of July 2023, the Office for National Statistics (ONS) reports.

The two main catalysts for this inflationary pressure have been the Covid-19 pandemic and the Russian attack on Ukraine.

More specifically, key supply lines have been damaged during these events and production has slowed. When production slows but demand remains, this pushes demand even higher, and prices increase – a process we all know as “inflation”.

One of the main techniques for controlling inflation is monetary policy, particularly interest rates. When inflation is low, the Bank of England (BoE) will typically lower the base interest rate to discourage borrowing and increase spending. When inflation is high, the opposite is usually true.

With an understanding of the above, it may come as little surprise that interest rates have been increasing since 2021. In August 2023, the BoE implemented its 14th consecutive base rate rise since December 2021, bringing the base rate to 5.25%.

Amid all this, you could be wondering: “how do the latest inflation and interest developments affect the stock market?”

Read on for our commentary on how interest fluctuations, prompted by inflation, can affect bonds and equities.

Rising interest rates can have a negative impact on equities

Unfortunately, high interest rates are generally bad news for equities.

This reality is reflected in the following recent stock market figures, reported by the London Stock Exchange, showing index performances in the year to 9 August 2023.

- The FTSE 100 is down by just over 6%.

- The FTSE 250 has dipped by 8.6%.

- FTSE AIM All Share is down by nearly 19%.

So, why does equity performance often dip when interest rates are high?

Simply put, most companies borrow to support growth. When rates increase, the cost of borrowing goes up. This reduces future profit projections, which can limit investor confidence and reduce share prices, which then feed through to individual investor portfolios like yours.

As an investor, it is crucial to have a mix of equity holdings within your portfolio. Diversification is key, and all the data points to taking a patient, long-term approach with regular reviews and adjustments (where necessary) along the way.

Bond performance can also be affected by rising interest rates

Rising interest rates can also cause challenges for existing bond holdings.

If you are holding a fixed-interest asset to maturity while central bank rates are increasing, your asset is likely to become less desirable in capital terms, as its value will fall.

You may, however, benefit from an increased yield as interest climbs.

And, more positively, rising rates can create new opportunities to lock into attractive yields, which may attract strong capital values on the secondary market if rates come back down again.

This facilitates the opportunity to rotate out of current bond holdings (if appropriate) and enter into new opportunities.

Speaking with a financial planner before making adjustments to your portfolio can help you act with confidence.

Although cash is seeing high returns, staying invested may be a beneficial move

As interest has continued to rise, we’ve been asked a lot about the attractiveness of cash. During the pandemic, some cash savings accounts saw as little as 0.1% interest – but in August 2023, Moneyfacts reports that you can now secure interest rates as high as 4.75% on an easy access savings account.

If you can gain almost 5% on your cash, you may be tempted to move a large portion of your wealth out of investments, especially when portfolios may be experiencing some challenges.

However, doing so could be short-sighted due to the following points:

- Consider how your cash savings match up with inflation. 5% on cash is still a negative return when weighed up against the present rate of inflation, which stands at 6.8%.

- Investments produce a range of outcomes. Yes, this means temporary losses may occur – but cash limits your potential for higher returns too.

- Historically, equities outperform cash when measured against inflation. Over the long term, cash has consistently been outperformed by equities.

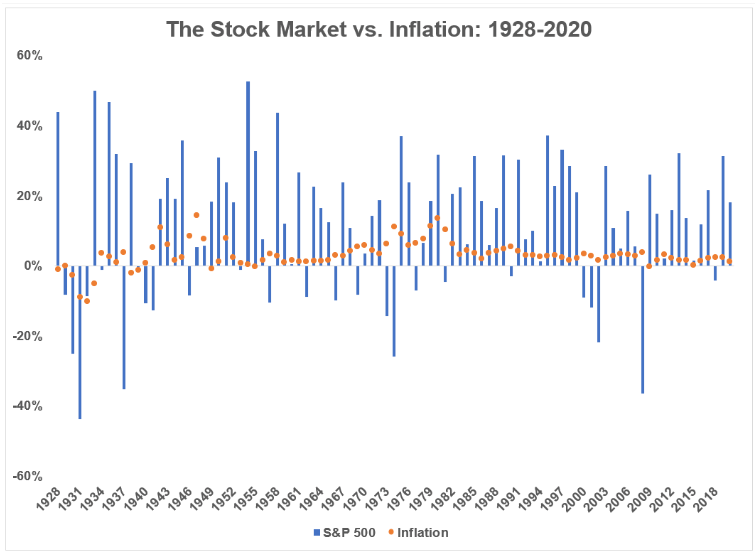

The below chart shows the performance of the S&P 500 index compared with inflation between 1928 and 2018.

Source: A Wealth of Common Sense

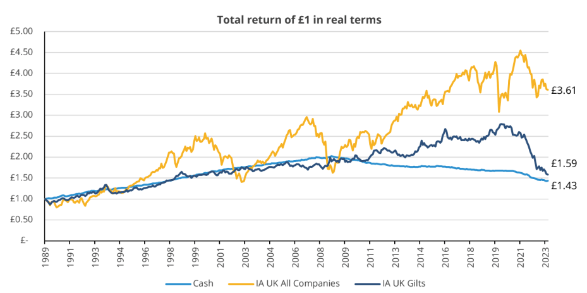

Additionally, this next chart shows how cash has performed against inflation, compared to equities, between 1989 and 2023.

Source: Square Mile and FE fundinfo. Data as of 30 June 2023.

All in all, despite the rockiness of the stock market since the pandemic, coupled with rising interest rates, cashing in your portfolio now could be unwise.

If interest rates fall sharply after a period of incline, your portfolio could be affected

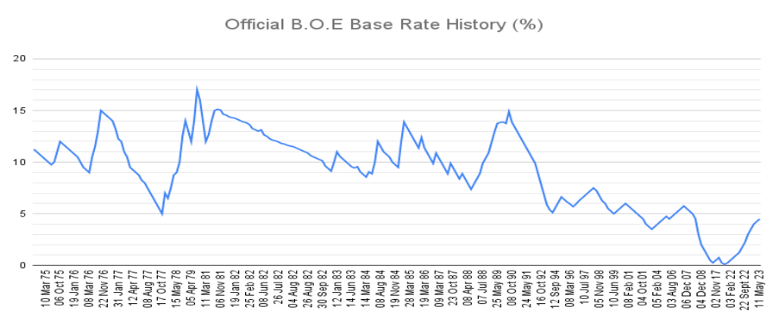

As you can see from the below graph, sharp declines have historically followed periods of high interest rates.

Source: House Price Crash

If this happens, we expect it to mean good news for markets and portfolios that we manage with the support of our carefully selected investment partners.

A resolution to the Ukraine war would also be expected to mean good things – most importantly for those directly affected, but also for economic conditions. We recognise that a resolution does not currently appear to be around the corner, but we of course all retain hope that an agreement will be reached in future and peace can resume.

Working with a financial planner can help you design a portfolio suited to your goals

Ultimately, we take the approach of “time in the market” and not “timing the market”.

Since the millennium, we have seen many serious events which have had a grave impact on stock market performance.

Yet these circumstances have not stopped the S&P 500 returning 379% over the period between the year 2000 and August 2023 (assuming that dividends are reinvested), according to Official Data Foundation figures.

Our portfolios are set up with quality underlying solutions as part of our diversified approach. Our investment committee meets quarterly to discuss our panel of solutions, monitor progress, and agree any updates.

Should you have any questions or wish to discuss matters relating to your portfolio, please do get in touch with your financial planner. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on How bond and equity markets have been affected by higher interest rates

There are 0 comments on How bond and equity markets have been affected by higher interest rates