16th March 2021

Our lives have changed significantly over the last year. Our habits, working practices, and relationships have all adapted to the situation we found ourselves in – from working from home to replacing restaurant meals with home cooking.

Of course, these changes have had a massive knock-on effect on the economy. So, a year on, here are five trends that have emerged from the pandemic and their impact on business.

1. An online shopping boom

As shops closed, everyone had to find new ways to shop. Whether it was groceries or gifts, you probably bought more online in 2020 than you had at any point in your life before.

Those companies already well-placed to pivot to digital sales performed fantastically. Bloomberg report that Amazon CEO, Jeff Bezos, saw his personal wealth grow from $115 billion in January to more than $200 billion in September.

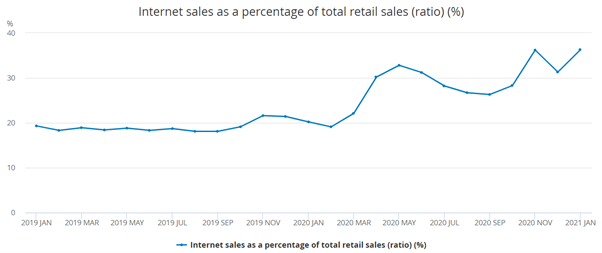

Companies from Zoom to ASOS were the big beneficiaries as the average weekly value of internet retail sales in the UK more than doubled, from just under £1.5 billion to £3 billion. Internet sales as a proportion of total sales grew from 22.1% as we entered the first lockdown in March 2020 to 36.3% as we entered lockdown again in January 2021.

Source: ONS

While its share price has fallen back, online electrical retailer AO World has been the best performing London listed company in the retail sector, seeing its shares rise by more than 305% since February 2020.

And, as you bought more and more online, shares in e-commerce and parcel delivery companies have also soared. Royal Mail saw its share price rise by 165% in 2020.

2. A struggle for survival in the hospitality sector

Pubs, restaurants, and hotels have been some of the biggest economic casualties of the pandemic. The global travel industry ground to a halt as quarantine measures and lockdowns prohibited overseas trips and holidays.

Figures from the Office for National Statistics show travel agencies, hotels and other businesses offering accommodation still had almost three-quarters (72%) of employees on partial or full furlough leave in January 2021.

The worst London listed performer in the travel and leisure sector was British Airways owner IAG, which saw its shares fall by 61% over the year.

Even with a vaccine roll-out, it looks like a long road back for the hospitality sector. People will need to be confident to book, and international travel could still be contingent on some sort of “vaccine passport” scheme.

3. Car use and new car sales plummet

It’s no surprise that a government message to “stay at home” saw car use plummet in 2020. If you drove on a motorway at the height of lockdown it was an almost surreal experience, akin to something you’d see in a post-apocalyptic Hollywood film.

Car use in the UK fell to around 20% of pre-pandemic levels during the first lockdown, and even when restrictions have been eased traffic has not recovered to pre-pandemic levels. The Guardian reports that car sales experienced the biggest slump since the second world war, falling 29% to 1.63 million.

In September to November 2020, the highest unemployment level across all industries was for those previously employed in motor vehicle wholesale, retail and repair, at 209,000.

4. The end of the high street?

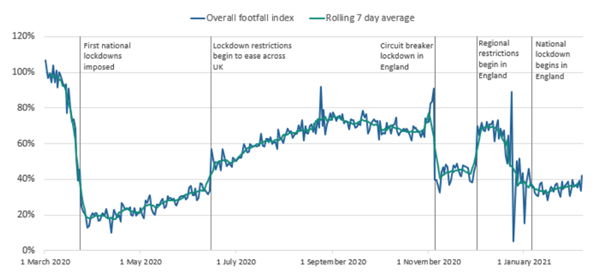

Just as with road traffic, footfall in shops also plummeted in 2020. With most stores closed, footfall fell to around a fifth of normal levels but, more worryingly, didn’t entirely recover even when shops reopened, and restrictions were eased.

Footfall on the high street and shopping centres has languished at around 60% of pre-pandemic levels, even when non-essential stores have been allowed to open.

Source: ONS

Many town and city centres are being left with a significant number of empty stores, as well-known retailers from Debenhams to Cath Kidston head online only. If more retailers struggle, it could make the high street revival even tougher.

5. Oil and gas suffer as the world focuses on climate change

As demand for energy from businesses fell sharply, the oil and gas sector has been the worst performing sector on the London Stock Exchange.

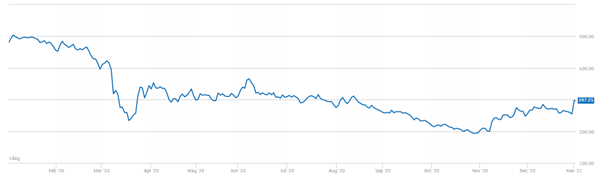

BP has been the worst performing London listed company in the oil and gas sector. Its share price fell from £4.94 in trading in early January 2020 to £1.97 in late October 2020 as it attempted a rapid energy transition amid sunken oil demand. Here’s the performance of BP shares in 2020.

Source: London Stock Exchange

How well oil and gas companies recover will depend on how quickly they can move to renewable energy, given the increase in demand for ESG investments from both individuals and institutions.

Get in touch

If you have any questions about limited company buy-to-let, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The Financial Conduct Authority does not regulate buy-to-let mortgages and tax advice. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Comments on From online retail to car sales: 5 pandemic trends and their impact on business

There are 0 comments on From online retail to car sales: 5 pandemic trends and their impact on business