14 February 2023

During the cost of living crisis, you might be cutting corners left, right, and centre in order to stay on budget.

With the Guardian reporting the UK will return to “2006 real-term wages” amid high inflation this year, it’s no surprise you might be looking to cut costs in all areas of your life. One of these areas could be your insurance, including life cover, critical illness protection, and income protection insurance.

Concerningly, Money Marketing reports that, in December 2022, 1 in 7 UK adults considered cancelling their life insurance amid the cost of living crisis. Only 3 in 10 of those polled considered insurance to be a “non-negotiable financial priority”.

If you aren’t convinced of the importance of protection, keep reading. Here’s why taking out cover in today’s world could be life-changing for you and your family.

Protection can prevent your family’s life from changing dramatically if the unexpected happens

Your income could underpin your entire family’s lifestyle. If it disappears, you’ll need a safety net.

Indeed, if you are the breadwinner of your household, your income is either wholly or mostly responsible for:

- Maintaining your family home

- The essentials, such as food, energy bills, transport, clothing, and home supplies

- Any holidays or trips your family goes on

- Helping your children through life, including paying education fees, or helping them onto the property ladder

- Your and your spouse’s retirement.

It’s uncomfortable to think about, but ask yourself: “how would my family’s life have to change if I were to pass away or become unable to work?”

Indeed, if you’re unprotected, unexpected events could be the catalyst for a sobering lifestyle shift. Luckily, it doesn’t have to be that way; cover can help reduce this risk.

Worryingly, research from The Exeter, published by Mortgage Strategy, found fewer than half (48%) of UK adults have any insurance, including:

- Life insurance

- Critical illness cover

- Health insurance

- Cash plans.

What’s more, your adult children could also be delaying taking out protective measures that might make all the difference in future. Professional Adviser reports that under-35s are missing out on “key milestones”, such as buying their first home, that might prompt a person to take out long-term insurance.

Here are three events that could change your families’ lives, and how protection might support your family if they were to occur.

1. You pass away

Of course, the prospect of dying unexpectedly might have kept you awake at night in the past. Consider this: if you were gone tomorrow, could your family sustain the lifestyle they’ve come to enjoy?

Without your income, your loved ones may struggle to pay essential bills, including your mortgage, and could have to uproot their lives as a result.

Luckily, if the worst happens, your family doesn’t have to enter financial hardship.

As you may know, when a life insurance claim is successful, your family will receive a tax-free lump sum payment, or a regular income. This support could help your beneficiaries pay off debts, continue their lifestyle, and pursue opportunities in their own lives without financial stress.

What’s more, if you are diagnosed with a terminal illness, some providers will give this lump sum before you pass away, so your family can plan for their future in good time.

2. You experience a life-changing illness or injury

Another key life event that could pose a risk to your family’s way of life is a serious illness or injury. According to the NHS, 1 in 2 people will get cancer in their lifetime – one of many somewhat worrying statistics.

If you were unable to work for a significant period of time (or the rest of your life), you could rapidly deplete your hard-earned savings without protection in place.

For instance, if you were diagnosed with cancer and couldn’t work, your entire life would change. Aviva reports those with cancer face an average of £891 a month to pay (on top of their usual bills), caused by things like travel, hospital parking, additional heating, and other factors.

Alternatively, you could put critical illness insurance in place before such an event happens. Critical illness cover is an often-overlooked form of protection that could transform your life if you became ill or injured and unable to work.

In the same report, Aviva states the average critical illness cover payout they paid in 2021 was £70,917. This is a lump sum payment that can be used for anything you like, including:

- Covering regular household costs

- Modifying your home, such as installing ramps or lifts

- Funding private healthcare if you wish.

While you may not wish to increase your expenditure in a time of high inflation, critical illness cover could make all the difference if the unthinkable occurred.

3. You are unable to work for a long time

If you consider similar circumstances to the above point – being too injured or ill to work – ask yourself: “how long could I afford to sustain my current lifestyle, while perhaps paying for additional care needs, on my savings alone?”

According to Money, the average UK citizen has £17,365 in their savings. Even if yours far surpass this figure, eating into your savings during the cost of living crisis is not an attractive prospect.

Fortunately, income protection insurance could help.

For instance, Legal & General’s income protection cover provides up to 60% of your gross annual income up to £60,000, then 50% above £60,000. The percentages and amounts vary between packages, but in short, you could get regular tax-free payments from your insurer if you can’t work.

The safety net of income protection insurance means you could keep up with mortgage repayments, continue to pay essential bills, and resist depleting your savings while you’re ill.

Protection payouts have increased in recent years

You could be thinking: “protection sounds great, but what’s the likelihood my claim is successful?”

Indeed, it’s understandable that you may be sceptical about the efficacy of long-term protection. Nevertheless, in recent years, you will be relieved to read that payouts have increased to record rates.

According to data from the Association of British Insurers (ABI), payouts increased across the board in 2021, including for Covid-19 related claims.

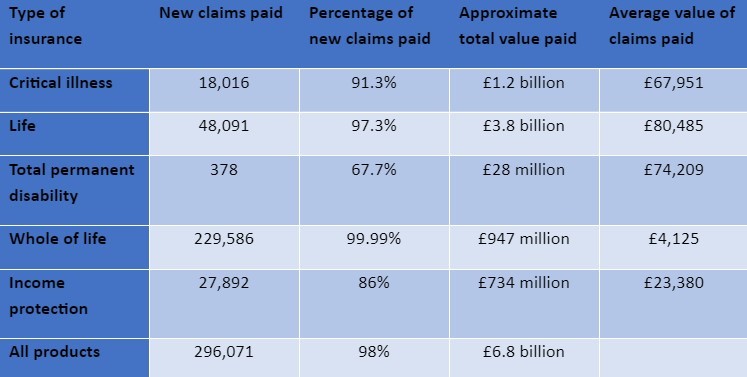

The below table shows the values of payouts in 2021 across many types of insurance, as well as the percentage of successful claims.

Source: ABI

As you can see, overall, 98% of protection claims were paid. This could bring you peace of mind in knowing that, if you needed to make a claim, it is likely you’d be successful.

In today’s uncertain world, your family deserves to feel confident they could weather any financial storm that came from an unexpected event. Although the hope is that you never have to make a claim, protection could be the safety net you need if the unthinkable happens.

Get in touch

If protection isn’t part of your financial plan already, it should be. Without it, your long-term goals could be fruitless if life throws an unpredictable event your way.

We can help assess your financial circumstances and suggest a package of protection that suits your long-term plan. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Note that protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse. Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

Comments on Fewer than half of UK consumers pay for long-term protection. Here’s why you should

There are 0 comments on Fewer than half of UK consumers pay for long-term protection. Here’s why you should