In recent years, it’s been tough if you are a saver. Interest rates on traditional savings accounts have remained low, and it’s often been hard to even beat inflation on easy-access and fixed interest savings products.

In recent months, rates have fallen yet further. Last month, National Savings & Investments (NS&I) became the latest provider to slash the rates on its popular savings products, with the rates on two of its most popular savings products set to be reduced to just 0.01% in November – that’s just £1 interest a year for every £10,000 invested.

While savings accounts offer a risk-free way of investing, record low interest rates can often mean your cash doesn’t keep up with rises in the cost of living, and so you lose out in real terms. So, is it worth considering the stock market as an alternative home for your savings?

Cash savings rates fall to record lows

A recent report from financial analysts Moneyfacts found that, between March and August 2020, the average easy access saving rate in the UK fell from 0.57% on 1 March to 0.22% on 1 August.

Since then, it has increased slightly but, at the start of September, it sat at just 0.23%. That’s an annual return of £23 for a £10,000 investment.

Recently, NS&I announced that they will also be reducing the rates on their products from 24 November 2020.

| Current interest rate | Interest rate from 24 November 2020 | Reduction | |

| Direct Saver | 1.00% gross/AER | 0.15% gross/AER | -0.85% |

| Investment Account | 0.80% gross/AER | 0.01% gross/AER | -0.79% |

| Income Bonds | 1.15% gross/1.16% AER | 0.01% gross/0.01% AER | -1.14%/-1.15% |

| Direct ISA | 0.90% gross/AER | 0.10% gross/AER | -0.80% |

| Junior ISA | 3.25% gross/AER | 1.50% gross/AER | -1.75% |

NS&I also announced that they were cutting the prize rate on Premium Bonds. Your odds of winning will fall from the current rate of 1 in 24,500 to 1 in 34,500 from the December draw onwards.

So, with cash savings rates now generating a measly return, is it time to consider stocks and shares?

Stocks and shares have outperformed cash in the last two decades

The first point to make here is that the choice between investing in cash and stocks and shares largely depends on two factors:

- Time – if you think you will need your money in the next five years, then it should typically be held as cash. Only consider investing if you are prepared to commit that money for the medium or long term.

According to the 2019 Barclays Equity Gilt Study, the stock market has outperformed cash in 69% of two-year periods, but 91% of ten-year periods.

- Risk – investing in the stock market has an element of risk. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. If you do not want to take any risk with your money, then you may be better served with a savings product such as those offered by NS&I.

However, while there may be no risk to your capital with a savings account (other than the failure of the bank if you deposit more than £85,000), there is a risk that your money will lose value in real terms. To preserve the long-term purchasing power of your wealth, you need to generate a return that is equal to or preferably higher than inflation.

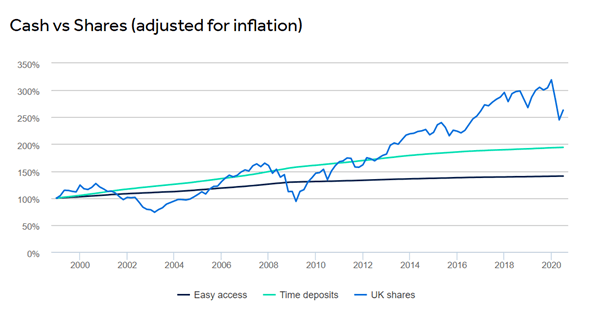

Here’s some data from the last two decades that compares the returns from cash, time deposits, and shares.

Source: HL

Since January 1999, when the Bank of England began recording data on effective interest rates, returns for savers in the average easy access account have failed to keep up with inflation.

As the graph shows, fixed-term savings accounts, where you lock your money away for a set period, have done better. Between January 1999 and June 2020, £100 grew to £194, or £128 after inflation.

In contrast, over the same period, the stock market turned £100 into £432 before costs. This works out to £284 after inflation. This is despite some very volatile periods, including the 1999/2000 dot-com bubble and the 2008 global financial crisis.

Over a longer term, the Barclays’ study shows that:

- £100 invested in cash in 1899 would be worth just over £20,000 now

- £100 invested in gilts in 1899 would be worth close to £42,000 now

- £100 invested in equities in 1899 would be worth around £2.7 million now.

So, if you’re prepared to invest for the medium or long term, stocks and shares could give you a better chance of outperforming inflation and meeting your financial goals.

Stock markets remain attractive for many investors

There’s one final point that’s worth making. One of the reasons you may be reluctant to invest currently is because of concerns regarding the volatility of global markets, particularly regarding the ongoing coronavirus crisis.

However, even in a recession, and even with a reasonable level of volatility, stock markets can remain an attractive option for investors.

With the UK Base rate at just 0.1%, and yields on bonds falling, markets continue to provide a good place for people to invest their money.

Larger UK corporations typically operate nationally or internationally, which means they are often technologically capable and well-positioned to compete in an environment of social distancing.

In addition, in a normal year, about 70% of the revenues generated by FTSE 100 companies come from overseas and so the performance of the UK economy does not always have a significant impact on profits.

Tara Sinclair, an economics professor at George Washington University, says: “People, particularly the rich, have cut back their spending, so they need to park their funds somewhere like the stock market (especially since interest rates are rock bottom).”

Considering the alternatives – an NS&I account that pays just £1 a year for every £10,000 you invest – shares remain an attractive option for medium to long-term investors, even in the middle of the deepest recession in history caused by a once-in-a-generation global pandemic.

Get in touch

If you’re concerned about the low rates on your savings and you want to explore alternatives, please get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The Financial Conduct authority does not regulate National Savings & Investments.

Equity investments do not afford the same capital security as deposit accounts. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be regarded over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on As savings rates tumble again, why now might be the time to invest

There are 0 comments on As savings rates tumble again, why now might be the time to invest