10th November 2021

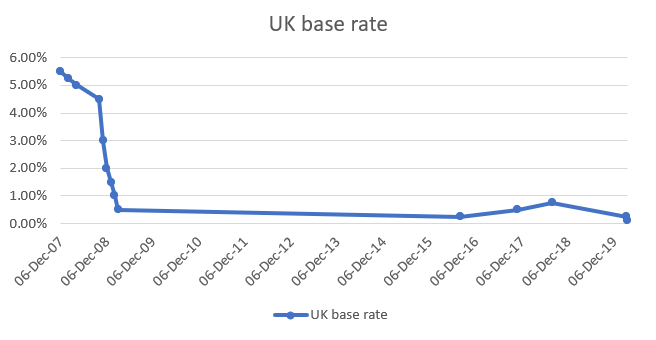

Since the global financial crisis in the late 2000s, interest rates in the UK have been at historic lows. Indeed, the Bank of England’s decision to cut the base rate in response to the initial lockdown saw rates fall to the lowest level in the Bank’s 326-year history.

However, a recent spike in inflation has raised the prospect that interest rates could be set to increase for the first time since 2018.

Read on to find an answer to the question “are interest rates set to rise?” and what an increase would mean for you.

Experts believe the Bank of England could raise interest rates soon

One of the main roles of the Bank of England is to keep inflation in check. The Bank of England target an annual inflation rate of 2%, although in recent months the rate has exceed 3%. The Bank itself predicts it could reach as high as 5% in the spring of 2022.

To control inflation, the Bank of England can use the lever of interest rates.

When interest rates are low, inflation tends to rise. In simple terms, this is because savers don’t receive much interest on their money, so are encouraged to spend it instead. Conversely, when rates are high, inflation tends to fall as more people squirrel away their money rather than spend it.

The most recent change to the base rate was a reduction to a low of just 0.1% at the start of the first lockdown in March 2020. This cut was designed to encourage spending to stimulate the economy as the pandemic struck.

Data from the Bank of England

If the Bank of England increases interest rates, inflation should fall. So, with inflation exceeding the Bank’s target, there has been much speculation that the base rate could be set to increase.

As with any economic decision, experts are divided as to exactly when a rise might occur. Some commentators expect an 0.15% increase in December and two additional 0.25% rises next year, bringing borrowing rates back to the 0.75% level seen before the pandemic.

The markets also expect a rise of 0.15%, from 0.1% to 0.25%, this year. This would be followed with a further increase to 0.5% by March next year and a rise to almost 1% by the end of 2022.

It’s interesting to note how quickly sentiment has changed. It was only a few weeks ago that investors were not anticipating the first move from the Bank of England until the summer of 2022.

While it’s now likely rates will rise, the one major concern of the central bank is that a rise in rates might choke an economy that is still recovering from a substantial GDP fall in 2020.

What an interest rate rise would mean for your savings

After more than a decade of rock-bottom returns, savers will welcome any increase in interest rates. Many of the leading high street banks currently pay just 0.01% interest on their most popular instant access accounts – that’s just £1 in annual interest for every £10,000 saved.

As of 27 October 2021, MoneySupermarket reports that even the highest-paying easy access account pays just 0.6% interest – way below the current level of inflation.

While any increase will benefit savers, it could take some time for the increase to filter through to savings account rates. Furthermore, banks and building societies have often been accused of failing to pass on the full interest rate rise to savers.

What this means is that it’s likely that many cash rates will remain below the rate of inflation, meaning your cash will continue to lose money in real terms.

What an interest rate rise would mean for your mortgage

While savers have struggled to generate inflation-busting returns in recent years, mortgage borrowers have benefited from exceptionally low rates.

This year it’s been possible to borrow at below 1%, with many lenders offering two- to five-year fixed rates at less than 2%.

Any increase in the base rate will see a rise in repayments for borrowers on variable- or tracker-rate products, which This is Money estimate as one in four homeowners.

According to the Guardian, if you have a £200,000 mortgage over 20 years, with a variable interest rate at 3.59%, you will pay an additional £15 a month if the rate goes up by 0.15%, as experts predict it will in the next few months.

If the base rate rises as predicted by another 0.25% in 2022, you would pay an additional £25 a month on top of the £15 mentioned above. Your mortgage would cost almost £500 more every year.

If you’re currently on a variable mortgage rate, such as your lender’s standard variable rate (SVR), it could pay to consider switching onto one of the low-cost deals currently available.

As well as reducing your monthly repayments, a fixed rate would also give you the peace of mind that you know exactly what your payments would be for a defined period. It also means your repayments won’t rise in the event of a further hike in interest rates.

Bear in mind that many deals come with “early repayment charges” and so you need to be sure that you can commit for the full length of the product you choose. Taking independent advice can ensure you get the right deal for your circumstances.

Get in touch

If you want to discuss how rising interest rates would affect you, please get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Comments on Are interest rates set to rise? What a rate hike means for your savings and mortgage

There are 0 comments on Are interest rates set to rise? What a rate hike means for your savings and mortgage