Every September, Pension Awareness Day features a series of events designed to help people to get more from their pensions. With Pension Freedoms having given retirees much more choice, it’s never been more important to take advice during both the run-up to retirement and once you start to draw your retirement income.

While your pensions are likely to form a significant part of your income when you retire, they are unlikely to be the only way you will fund your lifestyle. Indeed, a major study by the Department for Work and Pensions (DWP) revealed that, for a pensioner couple, only around two-thirds of retirement income will come from pensions.

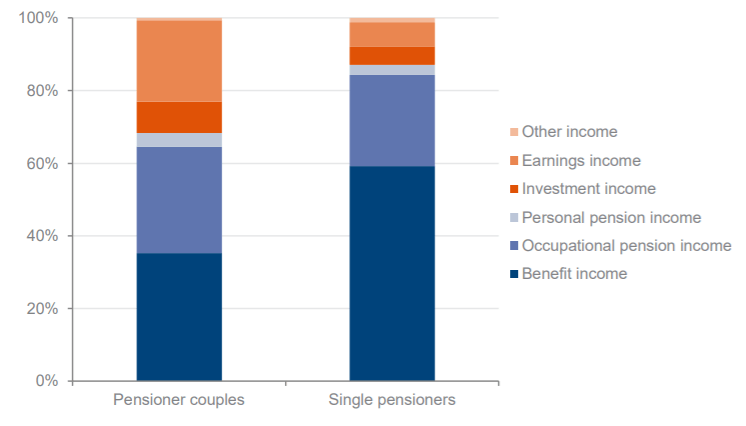

Where your retirement income will come from

In 2018, the DWP undertook a major study into where retirement income came from.

They found that pensioners receive income from a range of different sources.

Benefit income (including from the State Pension) was the largest component of total gross income for both pensioner couples and single pensioners, at 59% for single pensioners, and 35% for pensioner couples.

Income from occupational pensions was 29% of total gross income for pensioner couples and 25% for single pensioners, while income from earnings made up 7% of the total income of single pensioners and 22% of the total income of pensioner couples.

So, how might you fund your lifestyle in retirement?

1. Earnings

In the past, you may have finished work on a Friday afternoon, received a toast from the boss, and woken up on Monday morning as a ‘retired’ person. These days, people are taking a much more phased approach to their retirement, perhaps by staying on part-time, working in a consultancy or mentor role, or even starting their own business.

Indeed, 2017 research from the University of Manchester found that one in four people ‘unretires’ and returns to the workforce within five years of initially stopping work.

If you enjoy your work, you may earn part of your income in retirement this way.

2. State Pension

The State Pension forms the bedrock of many retirement plans. To receive the full State Pension, you must have 35 qualifying years on your National Insurance record. This will include the years you paid National Insurance while employed but it is also possible to build up credits when you’re raising a family, in full-time education or caring for someone that has a disability.

For the 2020/21 tax year, those receiving the full State Pension will receive £175.20 per week, or £9,110.40 annually. At present, the triple-lock system also ensures that your income keeps pace with inflation, as the State Pension increases annually by the highest of three measures:

- Price inflation

- Average earnings growth

- 2.5%

3. A Defined Benefit (Final Salary) Pension

If you’ve worked for a large employer, or in the public sector, then you may well have the security of a Defined Benefit, or Final Salary, pension.

This is a pension that is calculated based on your:

- Years of service

- Your pensionable earnings (perhaps your average salary or your salary at retirement)

- An accrual rate (the proportion of your earnings you’ll receive as a pension for each year you were a member of the scheme. This is typically 1/60th or 1/80th).

Most Defined Benefit schemes have a retirement age of 65, and you should receive regular statements indicating how much pension you can expect to receive at retirement age. You may be able to take a tax-free lump sum, and your pension will typically be paid to you monthly, in much the same way as your salary.

4. A Defined Contribution pension

With many Defined Benefit schemes having closed to new members, the majority of workers currently saving for their retirement will be doing so in a Defined Contribution scheme.

You build up a pension pot in a Defined Contribution pension through:

- Your contributions

- Contributions from your employer

- Investment returns

- Tax relief.

At retirement, you have a range of choices as to how you access this money. You can buy an Annuity (a guaranteed income for life) or leave the funds invested and use Drawdown to take lump sums or regular income as and when you need it.

This is a complex area, and it can pay to take professional advice when you come to draw your retirement income.

5. Investments

The DWP study found that 60% of all pensioners receive some sort of investment income. This can come from a range of sources including:

- Income from investments such as bonds and funds

- Dividends from shares

- Interest from savings accounts

- Buy to Let property

You may have built up savings in ISAs over the years which you can draw tax-efficiently, or you may own a property that generates rental income.

Get in touch

It’s likely that your retirement income will come from a range of sources. While this flexibility has plenty of benefits, it can present challenges from a tax and estate planning perspective.

For example, as pension funds can be passed down through generations tax-efficiently, you may decide to take your income from other sources in the early years. But how does this affect your tax position?

Taking advice as you approach retirement can be hugely beneficial and, as experts, we can help. Email info@depledgeswm.com or call (0161) 8080200.

Please note

A pension is a long-term investment not normally accessible until 55. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Comments on 5 places your retirement income will come from

There are 0 comments on 5 places your retirement income will come from