16 May 2023

Renowned author JRR Tolkien died 50 years ago at the age of 81. Despite his passing away, his most famous works, the trilogy of The Lord of the Rings books, have lived on in true ubiquity, remaining part of Britain’s cultural canon to this day.

This trilogy is a tale of heroism, friendship, possession, and the triumph of good over evil. And, if you look outside of Middle Earth and into the real world, you’ll find The Lord of the Rings is packed full of life lessons that are worth heeding, even almost 80 years after the first novel was published.

In the realm of investments, things have not been smooth sailing in the past few years. With the Covid-19 pandemic and high inflation rocking markets, you could have found these short-term fluctuations a little nerve-wracking.

Not to worry, though – there’s plenty to be learned about the value of long-term thinking, calculated risks, and true allyship in tough times from our good friend JRR Tolkien.

Keep reading to find out what timeless classic The Lord of the Rings can teach you about managing your long-term investment journey.

1. The outcome is uncertain, but the journey is often worth it

When Frodo is tasked with delivering the Ring to Mordor, he has no idea of the journey that lies ahead. Keeping the Ring from evil Sauron is a hugely important mission, but that doesn’t mean the road will always be smooth. If the Fellowship can’t destroy the Ring once and for all, life as they know it will never be the same.

In a similar vein, establishing an investment portfolio can be like starting a long journey – you have no idea what’s next, but ultimately, giving your wealth the chance to grow can help you to achieve your specific goals.

Especially in a time of high inflation – the Office for National Statistics (ONS) reports inflation reached 10.1% in the year to March 2023 – long-term investment returns could make all the difference to your wealth.

If kept in cash long-term, your money is highly likely to lose spending power. For instance, according to the Bank of England (BoE)’s inflation calculator, an asset that cost £50,000 in 1999 would have cost £75,394.91 in 2020.

Whereas, as Schroders reports, the FTSE 100 returned 122% between 1999 and 2020 (including dividends) – an average of 4% a year. So, if invested in 1999, your £50,000 invested could have stood at £111,000 by 2020.

Leaving your wealth in cash is the “easy” option – just like it would have been “easy” for Frodo to shirk responsibility of the Ring and allow Sauron to return to power.

On the other hand, establishing an investment portfolio, while an uncertain path to take, could be the journey your wealth needs to help you achieve your goals later in life.

2. Exposing your wealth to risk is not always a bad thing

Along the winding road to Mordor, Frodo and his trusted friend, Sam, encounter many treacherous circumstances.

In the second part of the trilogy, The Two Towers, Gollum leads Sam and Frodo through the Dead Marshes, a hazardous region of Middle Earth where many have died before them. It is the only way to continue the journey, but with their lives in danger, Frodo and Sam are understandably worried about what could happen when they enter the Dead Marshes.

As an individual who has worked hard for your money, you might feel reluctant to expose it to risk through investing. When markets prove volatile, as they have since the Covid-19 pandemic arrived, your portfolio could lose value in the short term and cause you to panic.

This is where long-term thinking comes in: if your portfolio enters the Dead Marshes, it can be tempting to simply turn back and go home – or in financial terms, crystallise your losses before they dip even further.

Yet experience tells us that, while past performance is not a reliable indicator of future performance, often the most lucrative results come from staying the course.

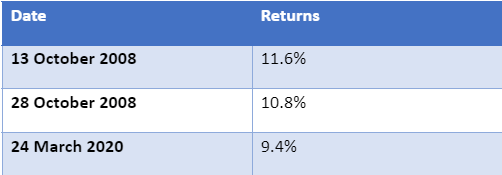

Take, for example, these figures from the S&P 500 Total Return Index, published by CNBC in March 2022.

The below table reveals the three days that provided the highest returns in a single day for this index.

Source: CNBC

Importantly, each of these days came during market declines. The top two points came amid the 2008 financial crisis, while the third-highest returns were seen days after Covid-19 lockdown announcements began.

If investors had crystallised their losses in the Dead Marshes of market volatility, their wealth would never have had the opportunity to recover soon after.

Longevity often trumps the seeking of short-term security, so next time you’re concerned about a dip in your portfolio’s value, think of the Fellowship’s brave battles through uncharted territory and consider staying invested.

3. Nobody should have to complete a long, winding journey alone

Although Frodo is the protagonist of Lord of the Rings, it is the entire Fellowship – eight friends committed to Frodo’s cause – who aid him in his journey to destroy the Ring.

In your own life, you’re the protagonist heading up the action. But without a band of experienced people around you, you could find it challenging to weather the long investment journey alone.

That’s where your financial planner comes in. As part of your Fellowship, a planner will watch your back when you face difficult terrain, help you think on your feet when unforeseen circumstances arise, and keep your mind focused on one thing: your long-term life goals.

Get in touch

Are you yet to form a Fellowship of experts who can help you brave the long investment journey ahead? Get in touch. Email info@depledgeswm.com or call 0161 8080200.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on 3 worthy lessons <em>The Lord of the Rings</em> can teach you about your long-term investment journey

There are 0 comments on 3 worthy lessons The Lord of the Rings can teach you about your long-term investment journey