18 March 2024

With 2024 in full swing, several factors, including GDP growth in Western nations, a surge in the value of tech companies, and robust employment figures, offer promising signs for market performance this year.

However, these indicators don’t guarantee a good year. Persistent inflation and ongoing conflicts in regions like Ukraine and the Middle East could introduce uncertainty as the year progresses.

While history rarely repeats itself, there is much we can learn from the past. Indeed, it’s 50 years since an energy crisis and global conflict – sound familiar? – led to some severe market volatility.

Continue reading to discover what happened during the 1974 stock market crash, and three lessons you can learn from the event five decades on.

War, an energy crisis, and a political scandal paved the way for the early-70s market crash

The early 1970s were, to say the least, marred by turbulence, with a perfect storm of events leading to a period of significant market uncertainty and volatility.

In 1973, oil-producing nations in the Middle East imposed an oil embargo on the US due to its support for Israel in the Yom Kippur War. This triggered an oil shortage, causing prices to rise considerably and dealing a blow to the US economy.

In fact, data reported by Statista reveals that the average Organization of the Petroleum Exporting Countries (OPEC) crude oil price rose from $1.82 a barrel in 1972, to $11 by 1974.

Adding to the turmoil, the imminent withdrawal of US troops from Vietnam further fuelled domestic discontent. Also, the Watergate scandal and President Richard Nixon’s subsequent resignation cast even more uncertainty over the US economy.

Forbes reports that the S&P 500, one of the US’s most significant stock market indices, experienced a maximum decline of 48%, contributing to a severe recession from 1974 to 1975.

While the crash occurred half a century ago, similar episodes have unfolded since, notably the Covid-19 pandemic in 2020.

This global health crisis resulted in a substantial market downturn, with Forbes revealing that the S&P 500 fell by more than 34% between its peak in February 2020 and its low point in March of the same year.

Whether you’re examining the recent uncertainty in 2020, or a crash that occurred 50 years ago, there are certainly some things to be learned from periods of market downturn. Read on to discover three of these lessons.

1. Market volatility is par for the course, it’s how you react that counts

Over the years, there have been plenty of incidents that have resulted in significant market downturn. Some of the worst crashes of the last 100 years include:

- The 1929 Wall Street crash, which started The Great Depression

- “Black Monday” in 1987, the single worst trading day since the 1929 incident

- The 2008 global financial crisis, culminating in the “great recession”.

When you look back on history, these seismic events often occur at regular intervals, making them seem almost like an inevitability.

Despite this, it’s important to note that while each of these events resulted in a period of volatility, markets continued to show an upward trend in the long term.

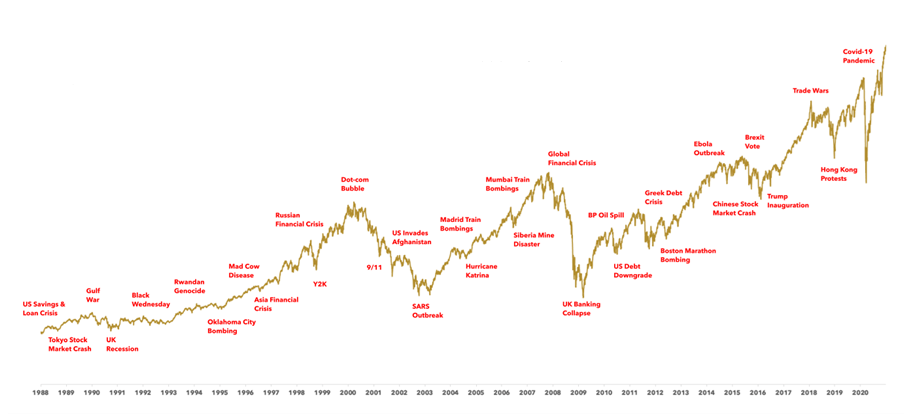

Take the graph below, which shows some of the world events that affected global stock market returns since 1988.

Source: Humans Under Management, Bloomberg

As you can see, while each event had an immediate effect on markets, returns trended upward over the course of the timeline. In fact, the above source states that the average annual return from the MSCI World Price Index across this period was 5.88%, excluding yearly dividends of 2%.

This is despite the fact that there were several significant drops in value along the way.

While you can’t control how the market performs, you can manage your reaction to periods of uncertainty.

One way you can do so is by remembering the tried-and-tested adage: “Time in the market, not timing the market.” In fact, data from Nutmeg shows that taking a long-term approach to investing can greatly benefit the value of your securities.

Indeed, if you had invested your wealth in the global stock market between January 1971 and July 2022, and you held onto that investment for 24 hours, you would have had a 52.4% chance of positive gains.

If you had held onto this same investment for a quarter, your chances of turning a profit rose to 65.6%, or even further to 94.2% over a 10-year period.

Of course, past performance isn’t a reliable indicator of future performance, and positive returns are never guaranteed. Regardless, the data does suggest that holding onto your investments through periods of uncertainty and staying the course could benefit your wealth in the long run.

2. Cashing out during a market dip means crystallising losses

When a period of market uncertainty does occur, and you watch the value of your portfolio start to decline, it can be tempting to cash out to minimise your losses.

However, by doing so, you’re essentially crystalising those losses forever and not giving your investments a chance to recover.

It can be helpful to compare stock market uncertainty to the housing market. For instance, if the housing market suddenly crashed and the value of your home dropped considerably, you likely wouldn’t immediately sell your property.

History shows that the housing market generally recovers, and applying this logic to investing could prevent you from knee-jerk reactions in response to a market downturn.

To further avoid market uncertainty from affecting your decision-making abilities, it’s vital to take a long-term view.

Take, for example, the performance of markets following the 1974 crash. While Macrotrends reveals that the S&P 500 fell from 840.06 on January 1973 to 407.45 by December 1974, the index eventually recovered to 889.14 by August 1987.

If you’d maintained a short-term view and sold your investments in response to the 1974 stock market crash, you would have missed the subsequent recovery.

3. Use the information at your fingertips

As you can imagine, it must have been comparatively more difficult for investors to gather the information they needed to make an informed investing decision in the early 1970s.

Meanwhile, in this digital age, you have a wealth of information right at your fingertips. This allows you to educate yourself about investing principles and could help you make informed decisions during a period of market uncertainty.

Moreover, the sheer amount of data that financial planners can access these days helps ensure we can guide you through periods of uncertainty.

For instance, by combining data about your assets, investments, income, and expenditure, we could use sophisticated cashflow modelling software to give you a detailed snapshot of how your potential future returns could look over the long term.

This could give you peace of mind during a period of market uncertainty, as it can indicate that you’re still on track to meet your financial goals.

Ultimately, we can use data to help you build a diversified portfolio, aligned with your tolerance for risk, that can help you progress towards your long-term goals.

Additionally, we can ensure that you remain calm and take a long-term view, even during periods of market uncertainty.

To find out more about how we could help, email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Comments on 3 lessons investors can learn from the 1974 stock market crash

There is 1 comment on 3 lessons investors can learn from the 1974 stock market crash

Comment by share trading tips for beginners

I thoroughly enjoyed reading your insightful blog post. Your perspectives and ideas were incredibly helpful.