15 October 2025

Each quarter, we share a global market update, which summarises significant events across major stock market indices.

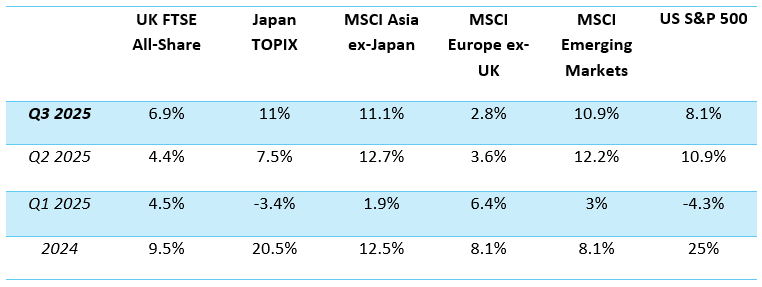

Compared to the relatively strong performance seen in Q2, the third quarter of 2025 delivered another period of steady gains across most markets.

Trade tensions eased and optimism around AI continued, while expectations of interest rate cuts helped sustain momentum.

Source: JP Morgan

Continue reading for a closer look at some of the main events driving these positive results.

UK

UK equities saw strong gains in Q3, with Schroders reporting that the FTSE 100 recorded its best quarterly performance since late 2022.

The FTSE All-Share also rose by 6.9%. While sterling is weaker and domestic economic conditions remain challenging, three-quarters of the index’s revenue is from companies abroad, which likely benefited returns.

Read more: As the value of sterling falls, what could it mean for your money?

Technology and communication sectors also benefited from AI enthusiasm, while basic materials gained support from high gold prices. The London Stock Exchange (LSE) also experienced a rise in initial public offerings.

As for inflation, rates remained somewhat high, with the Consumer Prices Index (CPI) at 3.8% in the 12 months leading to August 2025. This was partly driven by pressures from food, energy, and utility costs.

Still, the Bank of England (BoE) reduced the base rate by 0.25% to 4%.

The BoE also announced a slowdown of its quantitative tightening programme, which might lower bond yields and borrowing costs. However, the narrow margin of the vote indicates ongoing uncertainty about inflation in the future.

In fact, gilt yields did manage to rise over the quarter, as investors weighed the gradual approach to monetary easing and still high public borrowing. Year-to-date net public sector borrowing was £11.4 billion higher than the March forecast.

Overall, confidence still improved as expectations for further rate cuts in early 2026 supported sentiment.

US

US equities delivered continued strong returns in Q3 2025. Indeed, the S&P 500 rose by 8.1%, while the Nasdaq Composite reached new record highs.

Schroders reported that markets were lifted by the Federal Reserve’s decision to cut interest rates in September 2025.

As was the case in the UK, technology and communication sectors in the US were strong performers. However, healthcare and energy did lag somewhat due to falling oil prices.

Still, economic data remains encouraging. A late-September change to Q2 Gross Domestic Product (GDP) showed annualised growth of 3.8%.

This might have been driven, in part, by steady consumer spending and contained inflation, which helped reinforce investor optimism for the rest of the year.

However, it’s important to note that the quarter did end on a note of uncertainty as political negotiations failed to prevent a government shutdown on 1 October 2025. This event is expected to create continued uncertainty for markets in Q4.

Eurozone

European equities also rose in Q3 2025, with the MSCI Europe ex-UK index up 2.8%.

According to Schroders, financials and healthcare drove these gains, while telecoms and communication services lagged. Strong earnings reports also supported bank shares.

The services sectors expanded significantly in Germany, Italy, and Spain. France has remained under pressure due to political instability.

In fact, the French prime minister, François Bayrou, resigned after his financial reforms failed to pass through parliament. He was succeeded by Sébastien Lecornu.

Inflation remained aligned with the European Central Bank (ECB) target of 2% in August, but September’s figure is expected to rise higher.

President of the ECB, Christine Lagarde, noted that the Eurozone had weathered US trade tariffs better than anticipated, with little effect on inflation.

Despite stronger domestic growth in some areas, foreign demand has remained weak, as new export orders fell for the 28th consecutive month.

Still, markets believe that the ECB has now ended its rate cuts, potentially suggesting that its easing programme is almost finished.

Asia

Asian markets were some of the strongest global performers in Q3 2025.

The MSCI Asia ex-Japan index gained 11.1%, while Japan’s TOPIX rose 11%. Both were supported by sustained demand for AI and improving trade conditions.

In Japan, sentiment improved as expectations of a Federal Reserve rate cut strengthened. Domestic political developments, such as anticipated party leadership changes, also increased appetite for risk.

Schroders highlights that cyclical sectors, namely energy, metals, and semiconductors, have benefited from global AI investment and higher commodity prices.

Meanwhile, corporate buybacks and dividend growth have shown that Japan’s ongoing governance reforms are improving shareholder returns.

Across the rest of the continent, North Asian markets saw gains. South Korea and Taiwan outperformed, driven by technology and semiconductor strength.

In fact, the MSCI Taiwan Index, which has an 83% weight to the tech sector, increased by 14.7% over the quarter.

Chinese equities also rose as policy support for AI and chip development outweighed weaker consumer spending.

The aforementioned rate cut and a weaker dollar have helped attract foreign capital, while rising gold and copper prices further supported the region’s exports.

Overall, Asia has continued to benefit from the AI boom and global monetary easing.

Speak to us about carefully managing your investments

The third quarter of 2025 has delivered more strong performances for global markets, supported by falling interest rates, resilient economic data, and sustained investor enthusiasm for tech and AI.

However, at Depledge, we understand just how quickly global conditions can change. Our team can help you build and manage a diversified portfolio designed to weather market volatility while allowing you to achieve your long-term goals.

Email info@depledgeswm.com or call 0161 8080200 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

The Financial Conduct Authority does not regulate tax advice.

Comments on Your Q3 2025 global market update

There are 0 comments on Your Q3 2025 global market update