In his spring Budget, the chancellor was keen to point out that, as a result of his measures, “nobody’s take-home pay will be less than it is now”.

While he may have resisted the temptation to raise Income Tax, VAT, or National Insurance contributions, Rishi Sunak’s announcements will see many people pay more tax in 2021 than they did before.

This is primarily due to the freezes on a range of tax allowances and exemptions. So, here are seven ways you could end up paying more tax this year – and what you could do to mitigate a higher tax bill.

1. If you hit the Lifetime Allowance and you want to draw your pension

The chancellor froze the Lifetime Allowance – the amount of tax-relieved pension savings you can accumulate – at £1,073,100 until 2026.

If the total value of your pension fund exceeds this limit, you face a tax charge of 25% if you take the surplus as income, and an eye-watering 55% if you take it as a lump sum.

(Note that, while for the majority this may be the case, the Lifetime Allowance is calculated at Benefit Crystallisation Events, not just at the point you take income).

Royal London say that more than a million people are expected to lose out, as market growth pushes savings pots over the threshold.

It won’t just be the super-rich that are affected. As an example, if your pension fund was worth £600,000 today, and achieved an annual return of 5%, you’d exceed the current Lifetime Allowance in just nine years’ time.

There are ways to mitigate Lifetime Allowance tax charges, so speak to us for advice.

2. If your income rises

In March, the chancellor announced two Income Tax freezes:

- The Personal Allowance would rise to £12,570 in April 2021 and then remain at that level until 2026

- The threshold for paying higher-rate tax would rise to £50,270 and then remain at that level until 2026.

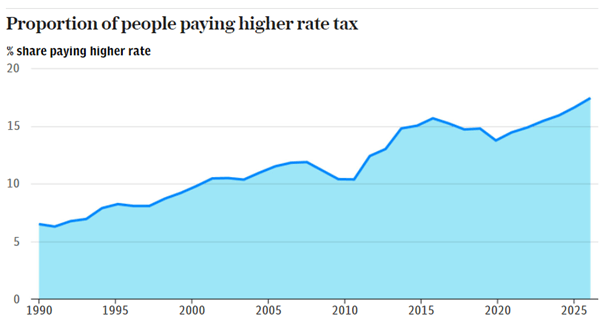

In its Budget report, the Institute for Fiscal Studies estimates that the proportion of higher-rate taxpayers is to rise from 8.7% to 11% of all adults by 2026 as a consequence of this freeze.

As wages continue to rise over the next five years, while the tax bands don’t increase, more people will either start paying higher-rate tax, or see a greater proportion of their income taxed at 40%.

Source: the Telegraph

It’s important to remember that becoming a higher-rate taxpayer doesn’t just mean you lose more of your earnings to tax. Other benefits – such as private health care, and income from any investments – may also become chargeable at 40% for the first time.

3. If you want to realise gains on assets

Each year, an individual can typically realise up to £12,300 in gains before paying any Capital Gains Tax (CGT). This is known as your “annual exempt amount”.

This exemption has also been frozen until 2026. So, if you’re selling assets – for example, non-ISA investments or a second property – then you may end up paying more tax on the profits.

If you become a higher-rate taxpayer over the next five years (as above) then you could end up paying 20% rather than 10% tax on the gain (or 28% rather than 18% if you make a profit on a residential property).

Estimates suggest this freeze will raise an additional £65 million for the Exchequer.

4. If you’re moving home

If you plan to move home later in 2021 then you’re likely to pay more Stamp Duty as the “holiday” ends at the end of June.

Until 30 June there’s no Stamp Duty to pay on a residential purchase up to £500,000, saving you up to £15,000 in tax. The threshold will fall to £250,000 until the end of September, after which it will revert to its original level.

If you want to save tax, it will be important to complete your purchase by the end of June – or at least by the end of September – to take advantage of the reduction.

5. If you inherit a valuable estate

The threshold at which Inheritance Tax becomes payable will remain at £325,000 until 2026. The residence nil-rate band, which you can use if you’re leaving property to a direct lineal descendent, will remain at £175,000 for the same period.

It was set at that level in 2009, so rising property prices and investment growth will see many thousands of estates caught by the duty in the coming years. Estimates suggest the move could raise £1 billion.

Gifting can be a good strategy for reducing the value of your estate. Individuals can gift up to £3,000 each year (and carry forward a previous year’s unused allowance) and you can gift unlimited sums up to £250.

Download our Inheritance Tax and gifting guide for more useful information.

6. If you receive Child Benefit

You may have to pay a tax charge, known as the “High Income Child Benefit Charge”, if you have an individual income more than £50,000 and either you or your partner receive Child Benefit.

As the £50,000 threshold won’t change, more and more families will have to repay some or all of their Child Benefit as their income rises over the next few years.

Indeed, as the threshold for paying higher-rate tax is rising to £50,270, some basic-rate taxpayers will be affected by the charge for the first time.

7. If you receive dividends

Many companies cut or suspended dividends in 2020 as a consequence of the uncertainty surrounding the coronavirus pandemic.

As the Dividend Allowance will remain at £2,000, if you have income from investments outside ISAs you could also start to pay more tax on dividends you receive from these shares and funds.

Get in touch

Good financial planning can help you to meet your goals by structuring your finances in a tax-efficient way. Find out how we can help you – email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor. The Financial Conduct Authority does not regulate tax advice.

Comments on 7 ways your 2021 tax bill could rise – and practical ways you can pay less

There are 0 comments on 7 ways your 2021 tax bill could rise – and practical ways you can pay less