15 October 2025

If you’ve been following the news lately, you’ll know that the value of the pound has slipped over the past few weeks.

Indeed, the Guardian reports that sterling fell by half a cent to $1.35 on 19 September 2025, putting it on track for its third consecutive daily decline.

At first glance, you might assume that changes in the value of the pound would only matter if you’re booking a holiday abroad.

In reality, currency movements can affect your day-to-day finances in several ways.

Understanding why sterling has weakened recently and how this could affect you can help you make more informed decisions about your wealth.

Global and domestic politics have caused the pound to slide in value

There isn’t one single reason behind sterling’s recent decline. Instead, it is due to a number of political events, market speculation, and changes in government borrowing costs.

One of these factors is the anticipation of Labour’s Autumn Budget on 26 November 2025. Some economists have suggested that tax rises could be on the way. The phrase “markets hate uncertainty” exists for a reason, after all.

When traders do expect significant changes in economic policy, which could come with the next Budget, they may move away from the pound, weakening its value.

Surprisingly, politics from other nations can also affect the pound’s value. Earlier in the year, US president Donald Trump introduced a range of new tariffs on countries around the world. This quickly sparked fears about a global trade war.

As such, confidence in international trade was shaken, which caused many investors to reassess their positions in currencies, including sterling.

The UK has also seen rising debt levels, which have placed further pressure on the pound. Sky News reports that the government recently completed a £14 billion sale of new 10-year bonds at the highest yield since 2008.

While high yields can attract new investors, they also increase the cost of financing debt.

This cycle of borrowing and repayment can strain the government’s finances, making markets more cautious about the UK’s economic outlook and, in turn, reducing confidence in the pound.

You might find that a weakened pound affects prices and your mortgage, but it’s not all bad

When the pound falls in value, the most immediate impact tends to be higher prices for goods and services. This happens because a weaker pound means imports are far more expensive.

Many businesses here in the UK rely on suppliers overseas, and if the pound falls in value against these currencies, they will often pass these increased costs onto the consumer.

This could affect everything from food and clothes to fuel and technology.

If higher prices do cause inflation to rise, the Bank of England (BoE) may increase the base rate in an attempt to keep it under control.

If you’re a homeowner, a higher base rate could mean you pay more for your mortgage. Tracker mortgages follow the base rate directly, while variable-rate mortgage providers will often set their repayment rates according to the BoE’s rate.

It’s worth noting that you likely won’t notice an immediate change if you have a fixed-rate mortgage. Still, you could face higher costs when you come to remortgage in the future if the base rate is still high.

That said, a weaker pound isn’t all negative. If you run a business that exports goods abroad, your products could become more competitive to buyers since they’ll be cheaper in foreign currencies.

Similarly, if you invest in UK companies that earn a portion of their revenue abroad, your portfolio could benefit. This makes a passive income from dividends more valuable when converted back into pounds.

It’s vital to remain calm and remember that currency volatility is relatively normal

While news about the pound’s decline might seem worrying at first, it’s vital to remain calm and stay focused on the horizon.

You should note that currencies are inherently volatile, and sterling has seen several rises and falls in recent years.

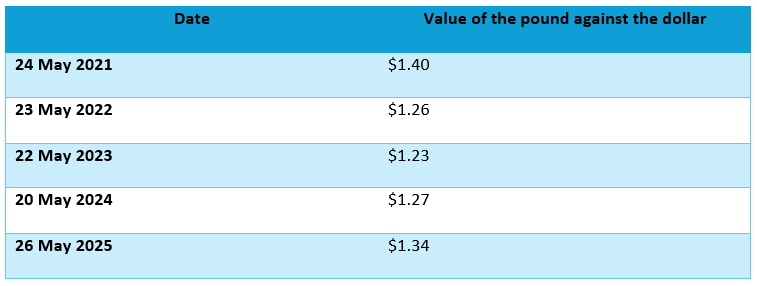

The table below shows how the pound has fluctuated against the US dollar over the past five years:

Source: Trading Economics

As you can see, sterling regularly moves up and down in value. Even between the dates mentioned, the value of the pound against the dollar has fluctuated significantly.

If you reacted to every short-term fall, you might make decisions that derail your progress towards your long-term goals.

Moreover, while the pound has been sliding in recent weeks, it’s essential to note that it still remains higher than it has been for much of the past year, Sky News reports.

This shows that the news tends to focus on the more negative headlines, as this drives readership.

Yet, it’s vital to look at the bigger picture, and you may see that things aren’t necessarily as bad as media outlooks might suggest.

A financial planner could help you focus on your long-term goals

Of course, it’s often easier said than done to remain calm when you’re constantly bombarded by negative headlines.

During uncertain times, it can be tempting to make quick knee-jerk decisions in response to market movements.

A financial planner could help you take a step back and focus on the bigger picture. We could build an investment strategy tailored to your circumstances, allowing you to gain clarity about how short-term events, such as a weaker pound, fit in with your long-term goals.

To learn more about how we can help, please email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

The Financial Conduct Authority does not regulate tax advice.

Comments on As the value of sterling falls, what could it mean for your money?

There are 0 comments on As the value of sterling falls, what could it mean for your money?