Your Q2 2025 global market update

Every quarter, we publish a global market review that breaks down the movements of key stock market indices and other important financial events from around the world.

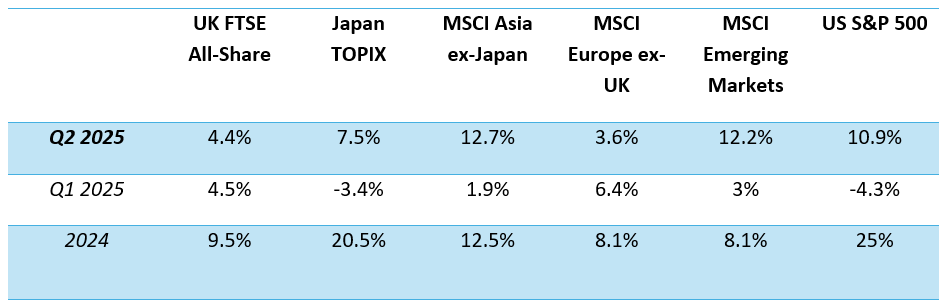

Compared to the first quarter of the year, where investors saw plenty of volatility, Q2 2025 proved positive for global markets.

Source: JP Morgan

Let’s break down the factors that contributed to the market growth demonstrated above, plus additional economic events to be aware of.

UK

One of the elements that influences investor confidence in the UK is the Bank of England (BoE) and its interest rate decisions.

In May 2025, the BoE cut the base rate of interest by 0.25%, bringing it to 4.25%. This move is a sign that the institution is confident that the rate of inflation is under control, although the Office for National Statistics (ONS) reports that, as of June, the rate of inflation stood at 3.6%, 1.6% above the BoE’s 2% target.

Elsewhere, the government’s Spending Review, delivered in June, focused on investing in public services – although controversy surrounding disability benefit cuts (and subsequent government indecision) may not have boosted consumer confidence.

Reacting to volatility elsewhere in the world (the Middle East and US, in particular), investors may have turned to UK shares as a safer option. The FTSE All-Share index returned 4.4% over the quarter, just 0.1% lower than its performance in Q1.

US

The US has certainly had a tumultuous year, with the new Trump administration causing market shocks due to tariff regulations placed on certain imports. On 2 April, the President announced “Liberation Day” by imposing harsh tariffs as planned.

In the week that followed Liberation Day, JP Morgan says that the S&P 500 fell 12%. Overall, there are several political question marks hanging over the US, which could prompt investors to back away from the region.

However, since the Trump administration reacted to this downturn by suspending its tariff package by another 90 days, the S&P 500 bounced back impressively.

Returning 10.9% in Q2, compared to the 4.3% downturn it experienced in Q1, the index has been bolstered by the Magnificent 7, a group of large-cap technology companies:

- Nvidia

- Tesla

- Apple

- Amazon

- Microsoft

- Meta

- Alphabet (Google’s parent company)

JP Morgan reports that together, these companies returned 18.6% over the quarter, outpacing the rest of the S&P 500 by 14 percentage points and contributing massively to the index’s growth.

Meanwhile, Schroders reports that US GDP growth was down 0.5% in Q1, which could spell further uncertainty for the region.

Eurozone

Several eurozone countries agreed to increase defence spending this quarter, Schroders states, giving defence stocks a boost and contributing to the overall market growth in the region.

Indeed, eurozone markets have had a great year so far, being the only region that returned positive growth in Q1. So, this continued positive performance exemplifies how European equities have been prioritised for diversification, particularly in the wake of US volatility.

According to Eurostat, eurozone inflation is expected to rise to 2% in June from 1.9% in May, remaining manageable and perhaps further prompting investors to favour the region.

Plus, this stabilisation led to the European Central Bank (ECB) cutting the central interest rate twice in the quarter, both by 25 percentage points, saying that it had “nearly concluded” its interest rate-cutting cycle, Schroders reports.

Asia

JP Morgan reports that easing trade tensions, combined with the depreciation of the US dollar, led to the region’s equity markets performing very well in Q2. Both the Japan TOPIX and the MSCI Asia ex-Japan outperformed their own growth from Q1.

Schroders also points out that fears surrounding a potential decline in tech output, due to the US tariff policies, were appeased this quarter, giving Asian equity markets a boost.

Speak to us about bespoke investment management

We understand that managing a diverse investment portfolio could be daunting, which is why our financial planners are here to help you bear the load.

No matter where you are on your investment journey, speak to us about managing your wealth throughout the ups and downs of market volatility.

Email info@depledgeswm.com or call 0161 8080200.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.