Your Q4 2025 global market update

14 January 2026

Each quarter, we share a global market update, which summarises significant events across major stock market indices.

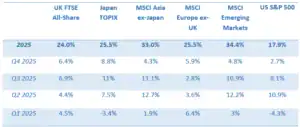

After a year of geopolitical power plays, rising trade tensions, and more uncertainty, the final quarter of 2025 delivered another period of steady gains across most markets.

Overall, 2025 was the first year since the pandemic where all major asset classes delivered positive returns, and several indices finished the year with record or multi-year highs.

Source: JP Morgan

Continue reading for a closer look at some of the main events driving these positive results.

UK

UK equities enjoyed strong gains in Q4. On New Year’s Eve, the FTSE 100 closed on a high, having gained 22% over the course of 2025 – its biggest annual gain since 2009. Meanwhile, the FTSE 250 climbed 9%.

This strong performance was primarily led by large, internationally focused companies in mining, defence, and other commodity-linked sectors due to strong global demand, elevated commodity prices, and a slightly weaker pound.

Meanwhile, British companies more reliant on the UK economy lagged, with consumer spending still under pressure.

UK inflation slowed to 3.2% in the 12 months to November 2025, thanks in part to slowing prices of food, alcohol and non-alcoholic beverages, and tobacco. Despite inflation persistently hovering above the 2% target throughout 2025, the Bank of England (BoE) cut the base rate by 0.25% to 3.75% – a decision driven in part by a weakening labour market and reduced wage pressures.

Overall, for UK equities, 2025 was one of the strongest years in more than a decade. Despite concerns about UK economic growth, the UK continues to attract investors seeking opportunities outside the US.

US

For the first time in several years, non-US equities significantly outperformed US markets throughout the year, Schroders reports.

Several ongoing issues have held the US market back: a weaker US dollar, attractive valuations outside the US, and some investors shying away from US technology stocks.

However, against a difficult domestic backdrop, including the longest government shutdown on record and rising job cuts, US equities showed positive gains in Q4 2025. The double-digit returns this quarter continues a trend that’s been ongoing for three straight years.

And despite the volatility and uncertainty created by President Trump’s tariff announcements, the S&P 500 delivered an increase of almost 18% over the year.

End-of-year volatility meant the market fell behind other global indices, but still delivered a strong performance and the decline has mostly been due to investors taking profit, rather than any fundamental issues.

Schroders reports strong performance from financials, healthcare, and utilities. And two “Magnificent Seven” firms also delivered stellar returns: Google (Alphabet) rose by 65% and Nvidia increased by more than 39%.

Meanwhile, Apple, Amazon, Meta (Facebook), and Microsoft failed to outperform the broader market, which may indicate that AI enthusiasm is ebbing away.

Read more: Is there an AI bubble? Is it about to burst? Your questions answered

US annual inflation fell to 2.7% in December 2025, its lowest level since July. And, despite inflation remaining above target, the Federal Reserve cut its policy rate to a range of 3.5% – 3.75% in December – the lowest level since 2022.

The market reacted positively to this further interest rate cut, and expectations suggest more cuts could be seen in 2026.

Eurozone

European equities extended their gains in the final quarter of 2025, closing the year on a resilient note. The MSCI Europe ex-UK Index rose 5.9% during Q4, contributing to a solid annual return of 25.5%.

Schroders reports that Eurozone markets were supported by broad-based equity strength, with major indices finishing the year near multi-year highs.

Financials were among the strongest performers, benefiting from lower global interest rates and improving lending conditions. Healthcare and utilities also attracted investor interest. In contrast, enthusiasm for growth and technology stocks moderated amid valuation concerns.

Eurozone GDP growth for 2025 was 1.3%, while inflation eased to 2% in December, broadly in line with the European Central Bank’s target.

The ECB held interest rates steady in December, citing easing inflation pressures and a cautiously improving growth outlook.

Asia

Asian markets delivered further gains in the final quarter of 2025, rounding off a strong year for the region.

The MSCI AC Asia ex-Japan Index rose 4.3% in US dollar terms during Q4, bringing its total return for the year to around 33%.

Performance continued to be underpinned by technology and AI-related themes, particularly in North Asia, where sustained demand for semiconductors, hardware, and data-centre infrastructure supported equity markets.

Japan was a standout performer. The TOPIX rose 8.8% over the quarter and finished 2025 up 25.5%, supported by easing inflation pressures and continued confidence in corporate reform.

Elsewhere in North Asia, Schroders reports that South Korea outperformed due to its heavy exposure to globally competitive chipmakers, while technology stocks across the wider region delivered more mixed but still influential returns.

In Southeast Asia, markets such as Indonesia, Malaysia, and the Philippines posted solid gains on the back of resilient domestic demand, while Thailand and Singapore lagged amid softer external conditions. India also advanced, supported by favourable growth dynamics and policy stability.

In China, targeted stimulus measures focused on industrial upgrading and green sectors provided selective support, despite ongoing challenges in property and consumer demand.

Overall, a year-end risk rally helped lift sentiment, reinforcing investor appetite for Asian equities heading into 2026.

Speak to us about carefully managing your investments

The final quarter of 2025 has delivered more strong performances for global markets, supported by falling interest rates, resilient economic data, and healthy consumer demand.

However, at Depledge, we understand just how quickly global conditions can change. Our team can help you build and manage a diversified portfolio designed to weather market volatility while allowing you to achieve your long-term goals.

Email [email protected] or call 0161 8080200 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.