Why you don’t have to sacrifice returns by choosing ESG investments

Last month, we looked at Good Money Week and the recent rise

in popularity of ESG investments.

As complex

global challenges arise, investors are reconsidering traditional approaches to investing.

Additionally, changes in attitudes are fuelling a demand for more ethical and

sustainable investments.

One of the criticisms that is often

levelled at investments that consider environmental, sustainable and governance

(ESG) aspects is that investors have to sacrifice some of their returns in

order to take an ethical stance.

It’s not just a view held by individuals. According to a survey by NN Investment Partners, more than half of professional investors still believe that incorporating ESG into their investment strategies will limit their overall returns.

However, research has found that this is

not necessarily the case. Keep reading to find out why ESG investing doesn’t

mean you have to accept lower returns.

Research

shows ESG investments are performing well

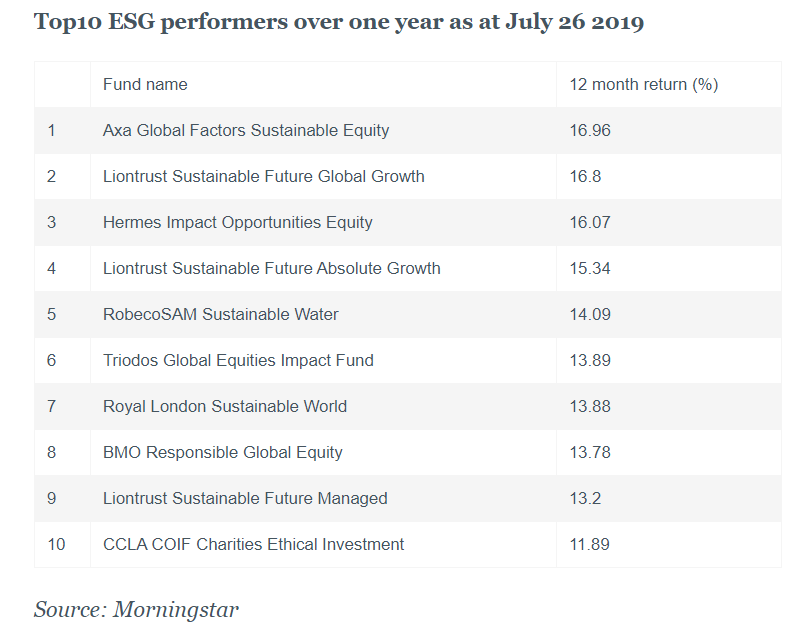

Recent performance data from Morningstar has poured cold water on the claims that some level of return must be sacrificed when choosing ESG investments.

The data – as of July 2019 – showed that the top three performing ESG funds all grew by more than 16% over a 12-month period. In addition, all of those occupying the top ten places recorded double-digit growth.

Separate research by Morningstar also found that 41 of the 56 (73%) Morningstar ESG indexes have outperformed their non-ESG equivalents since their inception.

The research follows a similar study by Interactive Investor, which found that ethical versions of funds have produced better returns than their standard counterparts in recent years, although any returns are not guaranteed.

A study of performance from six ethical funds with conventional equivalents

found that five of the ESG funds had outperformed over the three years to

the end of August 2019. Four of the ethical funds also came out top in the

first eight months of 2019.

Moira O’Neill, Head of Personal Finance at Interactive Investor, said: “The

data provides further evidence that you don’t have to compromise returns to

invest ethically. In many cases, ethical funds have a solid track record of

outperforming similar funds run by the same investment house.”

While investors don’t have to sacrifice returns to invest ethically, most

say that they are prepared to accept lower growth if it meant they took a more

responsible approach.

NN Investment Partners found that, on average, investors said they were prepared to forgo 2.4% a year if it meant their investments had a positive, non-financial, impact.

Why might ESG investments offer better returns?

There have been plenty of studies which suggest that companies with sound

ESG practices:

- Display a lower cost of

capital - Are less volatile

- See fewer instances of

bribery, corruption and fraud.

Considering these factors, it’s perhaps no surprise

that numerous academic and investor studies have found historically lower risk,

and even outperformance over the medium to long term, for portfolios that

integrated key ESG factors alongside rigorous financial analysis.

What are the

main sustainable methods that fund managers use?

There are

several strategies that fund managers use to ensure that they meet their ‘ESG’

mandate.

One such strategy

is ‘negative screening’. This avoids certain industries because of the damaging

or negative effects of their products and includes examples such as tobacco or

weapons.

The opposite

of this is ‘positive screening’. Peter Michaelis, Head

of the Liontrust Sustainable Investment team, explains: “Another approach is to

invest in sustainable themes. This is known as positive screening, as it sees

funds focusing on what they want to invest in, rather than what they want to

cut out.

“Such funds may concentrate on a single theme such as

renewable energy while others have multiple sustainability themes that can

include healthcare, resource efficiency, and education.

“Many cling to the perception that ethical investment

is about what you can’t do, whereas we think it’s about what you can do.”

A third method involves engaging with the companies

that managers invest in. This is called ‘impact-investing’ and is about

encouraging the management of firms to make positive changes to their strategy.

Kate Elliot, a Senior Ethical Researcher at Rathbone

Greenbank Investments, says the starting point for any discussion around ESG

always comes back to terminology. She asks: “How inclusive is the use of the

term ESG in this instance? Does it include funds with a sustainability,

thematic or impact bias, or just those integrating ESG analysis into the

broader investment process?”

Despite these further nuances, Ms Elliot adds that,

generally, the aim for most ethical investors is the desire to avoid harm and

promote positive change.

“Alongside the selection of ethical and sustainable

investments in the first place, an active approach to the ongoing management of

investments promotes positive change through more robust voting and

engagement.”

Get in touch

Want to have a chat about your investments or the pros

and cons of ESG investments? Get in touch. Email info@depledgeswm.com or call (0161) 8080200.

Please note

The value of your investment (and any income from them) can

go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investing

in shares should be regarded as a long-term investment and should fit in with

your overall attitude to risk and financial circumstances.