How to make the right choices as you build your pension pot

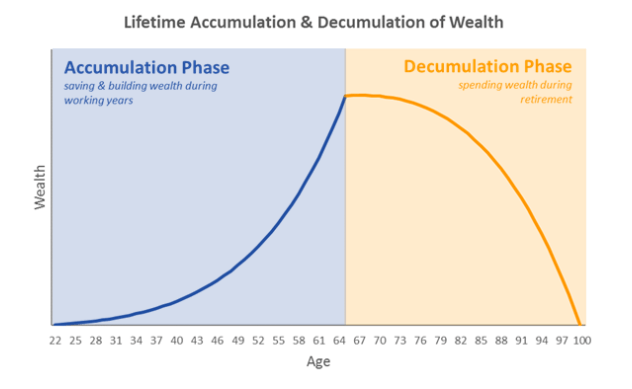

If you’re building up a savings pot for your retirement, then you’re in the ‘accumulation phase’.

The aim of accumulation is to save and build wealth during your working years, so that there is sufficient for you to maintain your required lifestyle in retirement.

During the years when many employees were paying into a Defined Benefit pension scheme, there did not need to be much thought as to the rate that pension wealth was generated. With a defined pension at retirement, individuals didn’t have to make significant decisions about how or where the funds were invested. As long as they had a significant number of years of service, they could be assured that they would have a decent income in retirement.

Now, as more and more people pay into Defined Contribution schemes, decisions made in accumulation are much more important. Millions of people will have to be much more focused on making sure they make the right decisions to achieve the desired income in the ‘decumulation’ stage.

So, what factors impact the choices you need to make in

accumulation?

Risk vs return

When you invest, the general rule is that the greater the potential for

growth, the more risks you may need to take.

Generally speaking, you will have to accept some level of risk when you

make any investment. The amount of risk you take depends on what you want to

achieve, how quickly you want your money to grow, and how much volatility you

are prepared to accept.

Every individual is different. Only you know what your aspirations are and

how much risk you’re prepared to accept to reach them.

Depending on the investment you select, the levels of risk and potential

investment performance differ. You will always face the risk that your money

could be worth less than it was when you originally invested.

A key part of the decisions regarding risk concerns how

much volatility you are prepared to accept. More volatile investments will tend

to see more sharp rises and falls in value, while less volatile funds will rise

and fall more slowly.

Choosing a high-risk investment

means that the value of your fund is likely to fluctuate more in value over

time – they may swing from being higher in value, to lower in value, more

often.

Choosing a low-risk investment means that your money is likely to fluctuate

by smaller degrees, but you are less likely to see higher overall growth.

Income vs growth

When investing, it’s important to consider whether you

need income immediately from your investments, or whether you’re prepared to

let your money grow over the long term.

If you require an income, then an income fund could be

beneficial as they combine the short-term benefit of regular income with those

of long-term investments.

If you don’t need the income, then you can reinvest this

which gives the fund the potential to grow faster.

Using tax-efficient vehicles

It

may seem obvious, but using tax-advantaged investments greatly helps in the

accumulation stage.

Pensions offer

significant tax advantages and, depending on the type of pension scheme you have,

tax relief either reduces your tax bill or increases the amount paid into your

scheme. In addition, your pension fund grows tax-free and you can usually take

up to 25% of your pension fund as a tax-free lump sum when you retire. Your

regular pension income is then taxed along with the rest of your income.

Additionally, using

tax-efficient vehicles such as an ISA, or a new Lifetime ISA (if you’re aged

between 18 and 39) can offer tax-efficient growth.

The changing face of retirement

Since Pension Freedoms were introduced in 2015, there has

been a sea change in how (and when) people take their pensions. This has

substantially changed the face of pensions accumulation.

Now there is no longer a ‘cliff-edge’ retirement, many

people don’t want to retire at 55 or 65. They want to continue accumulating

pension wealth way past the age of 55, within the annual and lifetime limits,

and so investment strategies have had to adapt to these changing needs.

Now, people might want to part retire, buy an Annuity

with a fixed level of income, take a lump sum, or put their fund into drawdown.

These options mean that providers and advisers face new challenges when it

comes to

providing a suitable and sustainable investment strategy.

For example, in the

past, investment strategies often focused on reducing investment risk as people

approached their retirement date. They would shift away from a high allocation

to riskier investments, such as equities, and into less volatile asset classes

such as index-linked bonds and gilts.

Now, with increasing

numbers of retirees continuing to accumulate wealth, even when retired, this

approach may no longer be appropriate or suitable for modern pension investors.

Don’t forget the State Pension

When considering the sources of your retirement income

during the accumulation phase, it’s important not to forget the State Pension.

Assuming that you have a full National Insurance

contribution record, the full amount of the new State Pension is currently

£168.60 a week (£8,767.20 per annum). For someone on average earnings, the

State Pension will provide roughly one-quarter to one-third of the desired

income in retirement.

Remember also

that you don’t have to claim the new State Pension as soon as you reach State

Pension age. Deferring claiming your State Pension means you may get extra

State Pension when you do claim it. For every 9 weeks that you defer taking

your State Pension, it will increase by 1% (equivalent at around 5.8% for every

full year you put off claiming).

Get in touch

Want to have a chat about your pension savings, and

whether you’re on track to accumulate the wealth you need to retire? Get in

touch. Email info@depledgeswm.com or call (0161) 8080200.

Please

note

A pension is a long-term investment not normally accessible

until age 55. The value of your investment (and any income

from them) can go down as well as up which would have an impact on the

level of pension benefits available. The tax implications of pension

withdrawals will be based on your individual circumstances, tax legislation and

regulation which are subject to change in the future.